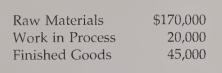

At the beginning of the year. Poison Manufacturing Company had the following balances in its inventory accounts:

Question:

At the beginning of the year. Poison Manufacturing Company had the following balances in its inventory accounts:

Poison applies overhead on the basis of 150 percent of direct labor cost. During the year.

Poison experienced transactions as described below.

L03, L04, LOS

a. Direct materials purchased, $280,000.

b. Direct materials issued, $300,000.

c. Indirect materials issued, $82,000.

d. Labor costs:

Direct labor $110,000 Indirect labor 60,000 Selling and administrative 70,000

e. Factory insurance expired, $5,000.

f. Advertising costs, $30,000.

g. Factory rent, $24,000.

h. Depreciation on office equipment, $10,000.

i. Miscellaneous factory costs, $7,850.

j. Utilities (70 percent factory, 30 percent office), $10,000.

k. Overhead was applied to production.

l. Sales totaled $983,000.

Ending balances in the inventory accounts were

Required:

1. Prepare journal entries for the preceding transactions.

2. Post the journal entries relating to manufacturing costs to the appropriate T-accounts.

3. Compute the under- or overapplied overhead variance. Give the journal entry that dis¬

poses of the variance by closing it out to Cost of Goods Sold. Give the journal entry re¬

quired to close out the variance if it is prorated among the appropriate accounts.

4. Prepare an income statement assuming that the variance is closed to Cost of Goods Sold.

Prepare another income statement based on prorating the variance. What is the differ¬

ence in income figures? Would you judge the difference to be significant?

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324002324

3rd Edition

Authors: Don R. Hansen, Maryanne M. Mowen