Larkin Company produces leather strips for western belts using three processes: cutting, de sign and coloring, and

Question:

Larkin Company produces leather strips for western belts using three processes: cutting, de¬

sign and coloring, and punching. The weighted average method is used for all three de¬

partments. The following information pertains to the Design and Coloring Department for the month of June.

a. There was no beginning work in process

b. There were 400,000 units transferred in from Cutting.

c. Ending work in process, June 30: 50,000 strips, 80% complete with respect to conver¬

sion costs.

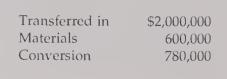

d. Units completed and transferred out: 330,000 strips. The following costs were added during the month:

e. Materials are added at the beginning of the process.

f. Inspection takes place at the end of the process. All spoilage is considered normal.

Required:

1. Calculate equivalent units of production for transferred-in materials, materials added, and conversion cost.

2. Calculate unit costs for the three categories of Requirement 1.

3. What is the total cost of units transferred out? What is the cost of ending work in process inventory? How is the cost of spoilage treated?

4. Assume that all spoilage is considered abnormal. Now, how is spoilage treated? Give the journal entry to accomit for the cost of the spoiled units. Some companies view all spoilage as abnormal. Explain why.

5. Assume that 80% of the units spoiled are abnormal and 20% are normal spoilage. Show the spoilage treatment for this scenario.

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324002324

3rd Edition

Authors: Don R. Hansen, Maryanne M. Mowen