Solve each of the following independent cases. (Assume all cash flows are after-tax cash flows.) 1. Hal's

Question:

Solve each of the following independent cases. (Assume all cash flows are after-tax cash flows.)

1. Hal's Stunt Company is investing $120,000 in a project that will yield a uniform series of cash inflows over the next 4 years. If the internal rate of return is 14%, how much cash inflow per year can be expected?

2. Warner Medical Clinic has decided to invest in some new blood diagnostic equipment.

The equipment will have a 3-year life and will produce a uniform series of cash sav¬

ings. The net present value of the equipment is $1,750, using a discount rate of 8%. The internal rate of return is 12%. Determine the investment and the amount of cash sav¬

ings realized each year.

3. A new lathe costing $60,096 will produce savings of $12,000 per year. How many years must the lathe last if an IRR of 18% is realized?

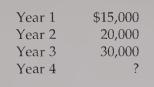

4. The NPV of a new product (a new brand of candy) is $6,075. The product has a life of 4 years and produces the following cash flows:

The cost of the project is 3 times the cash flow produced in Year 4. The discount rate is 10%. Find the cost of the project and the cash flow for Year 4.

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324002324

3rd Edition

Authors: Don R. Hansen, Maryanne M. Mowen