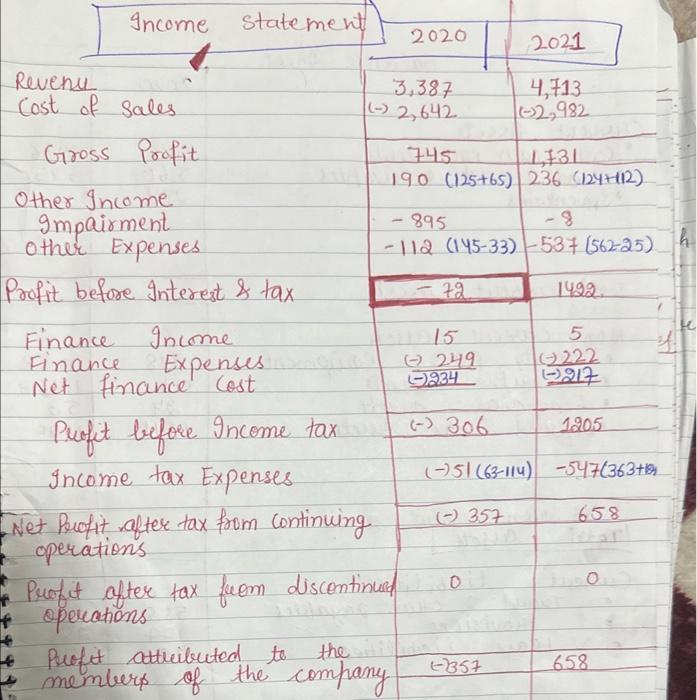

Calculate the following ratios for both 2021 and 2020 years: current ratio, quick ratio, debt to equity ratio, debt ratio, gross profit ratio, net profit

current ratio, quick ratio, debt to equity ratio, debt ratio, gross profit ratio, net profit ratio, return on equity, return on total assets, Inventory turnover ratio, inventory turnover( number of days), Market value($), Return on shareholders equity.

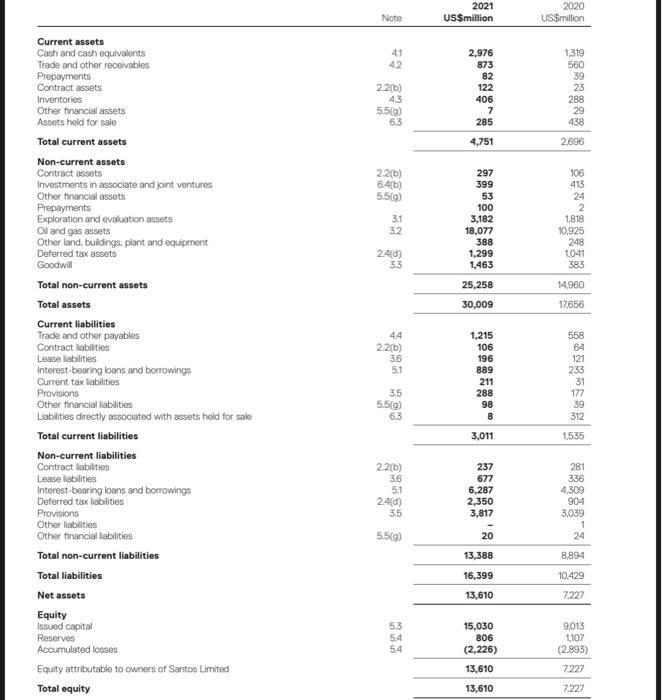

Current assets Cash and cash equivalents Trade and other receivables Prepayments Contract assets Inventories Other financial assets Assets held for sale Total current assets Non-current assets Contract assets Investments in associate and joint ventures Other financial assets Prepayments Exploration and evaluation assets Oil and gas assets Other land, buildings, plant and equipment Deferred tax assets Goodwill Total non-current assets Total assets Current liabilities Trade and other payables Contract liabilities Lease liabilities Interest-bearing loans and borrowings Current tax liabilities Provisions Other financial liabilities Liabilities directly associated with assets held for sale Total current liabilities Non-current liabilities Contract liabilities Lease liabilities Interest-bearing loans and borrowings Deferred tax liabilities Provisions Other liabilities Other financial liabilities Total non-current liabilities Total liabilities Net assets Equity Issued capital Reserves Accumulated losses Equity attributable to owners of Santos Limited Total equity Note 41 42 2.2(b) 4.3 5.5(g) 6.3 2.2(b) 6.4(b) 5.5(g) 3.1 3.2 2.4(d) 3.3 44 2.2(b) 36 5.1 3.5 5.5(g) 6.3 2.2(b) 3.6 5.1 2.4(d) 3.5 5.5(g) 5.3 5.4 5.4 2021 US$million 2,976 873 82 122 406 7 285 4,751 297 399 53 100 3,182 18,077 388 1,299 1,463 25,258 30,009 1,215 106 196 889 211 288 98 8 3,011 237 677 6,287 2,350 3,817 20 13,388 16,399 13,610 15,030 806 (2,226) 13,610 13,610 2020 US$million 1,319 560 39 23 288 29 438 2,696 106 413 24 2 1,818 10,925 248 1041 383 14,960 17,656 558 64 121 233 31 177 39 312 1.535 281 336 4,309 904 3,039 1 24 8,894 10,429 7,227 9,013 1,107 (2.893) 7227 7,227

Step by Step Solution

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the ratios for both 2021 and 2020 well use the given financial information Here are the calculations for each ratio 1 Current Ratio The c...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started