Answered step by step

Verified Expert Solution

Question

1 Approved Answer

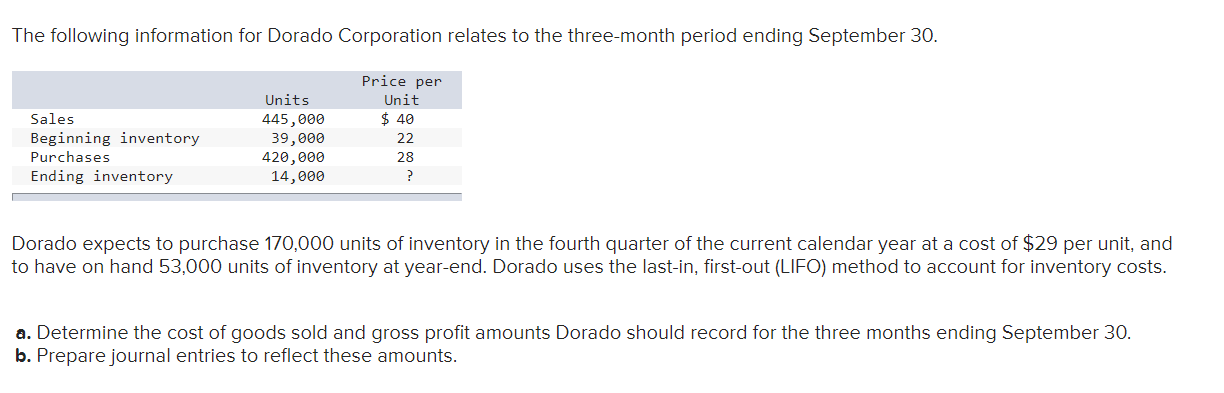

The following information for Dorado Corporation relates to the three-month period ending September 30. Price per Units Unit Sales 445,000 $ 40 Beginning inventory

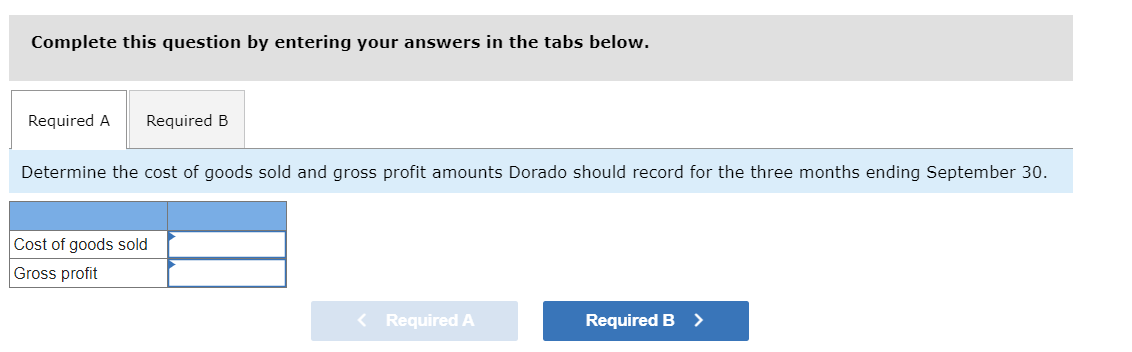

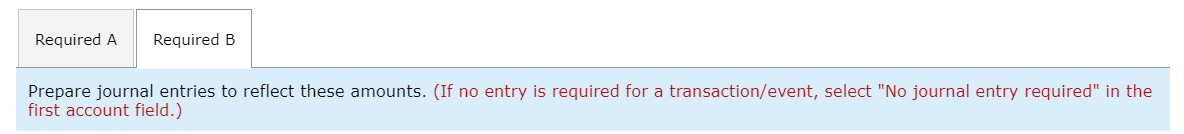

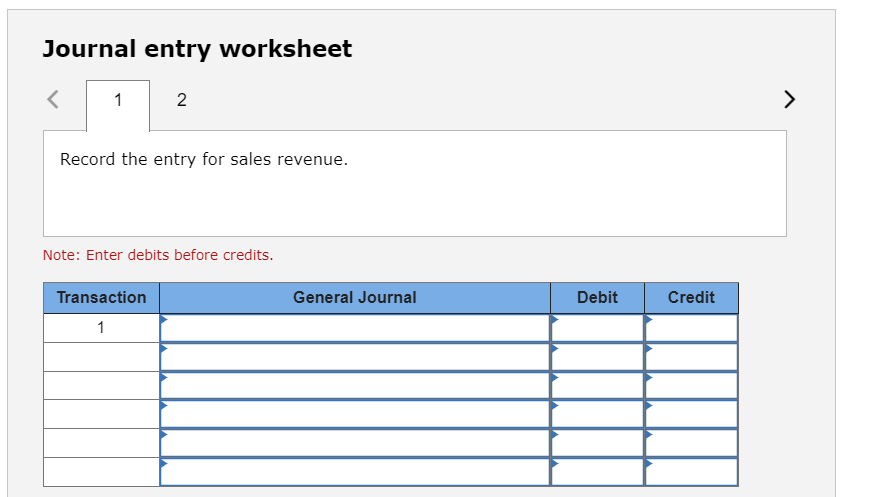

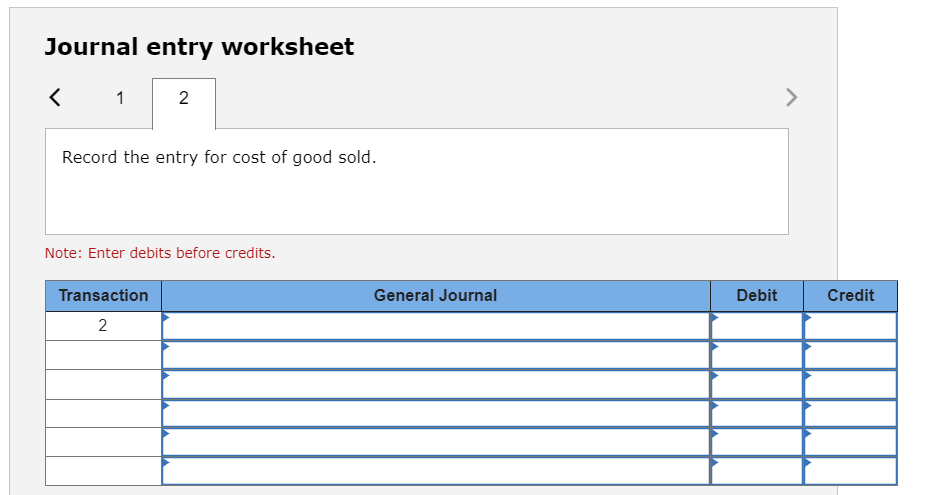

The following information for Dorado Corporation relates to the three-month period ending September 30. Price per Units Unit Sales 445,000 $ 40 Beginning inventory 39,000 22 Purchases 420,000 Ending inventory 14,000 28 ? Dorado expects to purchase 170,000 units of inventory in the fourth quarter of the current calendar year at a cost of $29 per unit, and to have on hand 53,000 units of inventory at year-end. Dorado uses the last-in, first-out (LIFO) method to account for inventory costs. a. Determine the cost of goods sold and gross profit amounts Dorado should record for the three months ending September 30. b. Prepare journal entries to reflect these amounts. Complete this question by entering your answers in the tabs below. Required A Required B Determine the cost of goods sold and gross profit amounts Dorado should record for the three months ending September 30. Cost of goods sold Gross profit < Required A Required B > Required A Required B Prepare journal entries to reflect these amounts. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 1 2 Record the entry for sales revenue. Note: Enter debits before credits. Transaction 1 General Journal Debit Credit Journal entry worksheet 1 2 Record the entry for cost of good sold. Note: Enter debits before credits. Transaction 2 General Journal Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the cost of goods sold COGS and gross profit for Dorado Corporation for the threemonth period ending September 30 we need to go through t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started