The controller of Gardner Company is gathering data to prepare the cash budget for April. She plans

Question:

The controller of Gardner Company is gathering data to prepare the cash budget for April.

She plans to develop the budget from the following information:

a. Of all sales, 30% are cash sales.

b. Of credit sales, 60% are collected within the month of sale. Half of the credit sales col¬

lected within the month receive a 2% cash discount (for accounts paid within ten days).

Twenty percent of credit sales are collected in the following month; remaining credit sales are collected the month thereafter. There are virtually no bad debts.

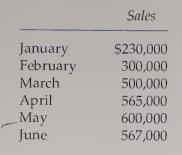

c. Sales for the first six months of the year are given below. (The first three months are actual sales and the last three months are estimated sales.)

The company sells all that it produces each month. The cost of raw materials equals 20% of each sales dollar. The company requires a monthly ending inventory equal to the coming month's production requirements. Of raw materials purchases, 50% are paid for in the month of purchase. The remaining 50% are paid for in the following month. j Wages total $50,000 each month and are paid in the month of incurrence. T Budgeted monthly operating expenses total $168,000, of which $22,000 is depreciation and $3,000 is expiration of prepaid insurance (the annual premium of $36,000 is paid on January 1).

Dividends of $65,000, declared on March 31, will be paid on April 15.

Old equipment will be sold for $13,000 on April 3.

On April 10, new equipment will be purchased for $80,000.

The company maintains a minimum cash balance of $10,000.

The cash balance on April 1 is $12,500.

Required:

Prepare a cash budget for April. Give a supporting schedule that details the cash collections from sales.

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324002324

3rd Edition

Authors: Don R. Hansen, Maryanne M. Mowen