The Glass Division of Sonnet, Inc., manufactures a variety of glasses and vases for house hold use.

Question:

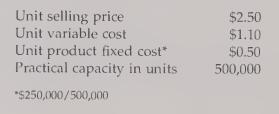

The Glass Division of Sonnet, Inc., manufactures a variety of glasses and vases for house¬ hold use. The vases can be sold externally or internally to Sonnet's Florist Division. Sales and cost data on a basic ten-inch vase are given below:

During the coming year, the Glass Division expects to sell 350,000 units of this vase.

The Florist Division currently plans to buy 150,000 vases on the outside market for $2.50 each. Neil Harper, manager of the Glass Division, approached Martha Strahorn, manager of the Florist Division, and offered to sell the 150,000 vases for $2.45 each. Neil explained to Martha that he can avoid selling costs of $0.10 per vase by selling internally and that he would split the savings by offering a $0.05 discount on the usual price.

Required:

1. What is the minimum transfer price that the Glass Division would be willing to accept?

What is the maximum transfer price that the Florist Division would be willing to pay?

Should an internal transfer take place? What would be the benefit (or loss) to the firm as a whole if the internal transfer takes place?

2. Suppose Martha knows that the Glass Division has idle capacity. Do you think that she would agree to the transfer price of $2.45? Suppose she counters with an offer to pay $2.00. If you were Neil, would you be interested in this price? Explain with supporting computations.

3. Suppose that Sonnet, Inc., policy is that all internal transfers take place at full manu¬

facturing cost. What would the transfer price be? Would the transfer take place?

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324002324

3rd Edition

Authors: Don R. Hansen, Maryanne M. Mowen