The PTO Division of the Galva Manufacturing Company produces power take-off units for the farm equipment business.

Question:

The PTO Division of the Galva Manufacturing Company produces power take-off units for the farm equipment business. The PTO Division, headquartered in Peoria, has a newly ren¬

ovated plant in Peoria and an older, less automated plant in Moline. Both plants produce the same power take-off units for farm tractors that are sold to most domestic and foreign tractor manufacturers.

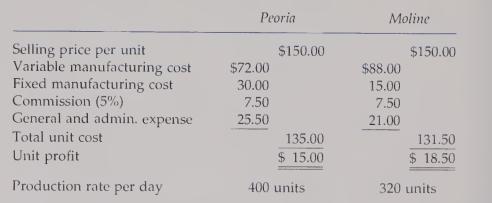

The PTO Division expects to produce and sell 192,000 power take-off units during the coming year. The division production manager has the following data available regarding the unit costs, unit prices, and production capacities for the two plants.

All fixed costs are based on a normal year of 240 working days. When the number of working days exceeds 240, variable manufacturing costs increase by $3.00 per unit in Peo¬

ria and $8.00 per unit in Moline. Capacity for each plant is 300 working days.

Galva Manufacturing charges each of its plants a per unit fee for administrative services such as payroll, general accounting, and purchasing, as Galva considers these services to be a function of the work performed at the plants. For each of the plants at Peoria and Moline, the fee is $6.50, and it represents the variable portion of the General and Administrative expense.

Wishing to maximize the higher unit profit at Moline, PTO's production manager has decided to manufacture 96,000 units at each plant. This production plan results in Moline operating at capacity and Peoria operating at its normal volume. Galva's corporate controller is not happy with this plan; he wonders if it might be better to produce relatively more at the automated plant in Peoria.

Required:

1. Determine the annual break-even units for each of PTO's plants.

2. Calculate the operating income that would result from sales of 192,000 power take-off units if 120,000 of them are produced at the Peoria plant and the remainder at the Mo¬

line plant.

3. Calculate the operating income that would result from the division production man¬

ager's plan to produce 96,000 units at each plant. (CMA adapted)

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324002324

3rd Edition

Authors: Don R. Hansen, Maryanne M. Mowen