Marston Corporation manufactures pharmaceutical products that are sold through a net work of sales agents located in

Question:

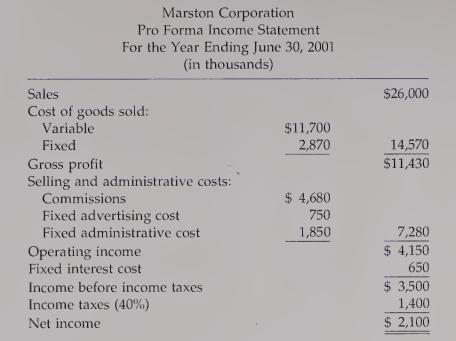

Marston Corporation manufactures pharmaceutical products that are sold through a net¬

work of sales agents located in the United States and Canada. The agents are currently paid an 18% commission on sales, and this percentage was used when Marston prepared the fol¬

lowing Pro Forma Income Statement for the fiscal year ending June 30, 2001.

Since the completion of the preceding statement, Marston has learned that its agents are requiring an increase in the commission rate to 23% for the upcoming year. As a result, Marston's president has decided to investigate the possibility of hiring its own sales staff in place of the network of sales agents, and has asked Tom Ross, Marston's controller, to gather information on the costs associated with this change.

Ross estimates that Marston will have to hire 8 sales people to cover the current mar¬

ket area, and the annual payroll cost of each of these employees will average $80,000, in¬

cluding fringe benefit expense. Travel and entertainment expense is expected to total $600,000 for the year, and the annual cost of hiring a sales manager and sales secretary will be $150,000. In addition to their salary, the 8 sales people will each earn commissions at the rate of 10% on the first $2 million in sales and 15% on all sales over $2 million. For plan¬

ning purposes, Ross expects that all 8 sales people will exceed the $2 million mark and that sales will be at the level previously projected. Ross believes that Marston should also in¬

crease its advertising budget by $500,000.

Required:

1. Calculate Marston Corporation's break-even point in sales dollars for the fiscal year ending June 30, 2001, if the company hires its own sales force and increases its adver¬

tising costs.

2. If Marston Corporation continues to sell through its network of sales agents and pays the higher commission rate, determine the estimated volume in sales dollars for the fis¬

cal year ending June 30, 2001, that would be required to generate the same net income as projected in the Pro Forma Income Statement just presented.

3. Describe the general assumptions underlying break-even analysis that might limit its usefulness in this case. (CMA adapted)

Step by Step Answer:

Cost Management Accounting And Control

ISBN: 9780324002324

3rd Edition

Authors: Don R. Hansen, Maryanne M. Mowen