Complete the following annual financial statement on the basis of ratios given below: Dr. To Cost of

Question:

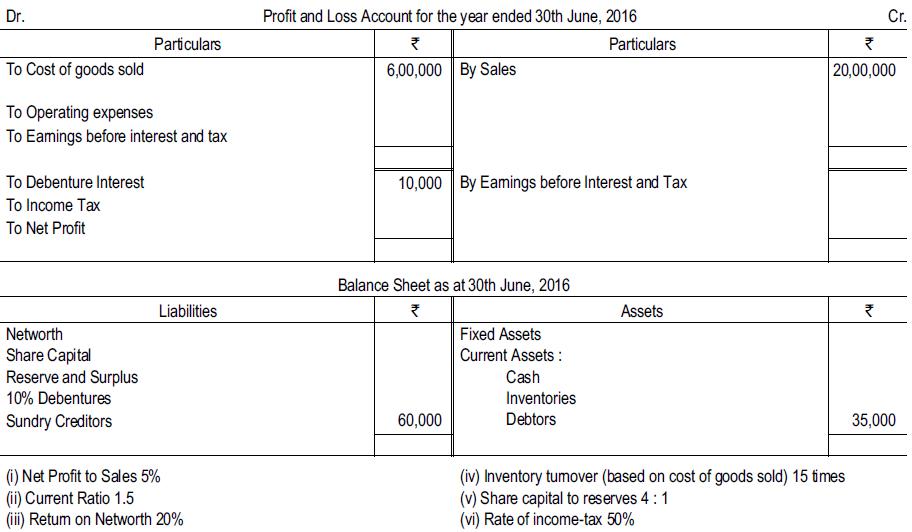

Complete the following annual financial statement on the basis of ratios given below:

Transcribed Image Text:

Dr. To Cost of goods sold To Operating expenses To Eamings before interest and tax To Debenture Interest To Income Tax To Net Profit Particulars Networth Share Capital Reserve and Surplus 10% Debentures Sundry Creditors Liabilities (i) Net Profit to Sales 5% (ii) Current Ratio 1.5 (iii) Retum on Networth 20% Profit and Loss Account for the year ended 30th June, 2016 ₹ 6,00,000 By Sales 10,000 By Eamings before Interest and Tax Balance Sheet as at 30th June, 2016 ₹ 60,000 Particulars Fixed Assets Current Assets: Cash Inventories Debtors Assets ₹ 20,00,000 (iv) Inventory tumover (based on cost of goods sold) 15 times (v) Share capital to reserves 4:1 (vi) Rate of income-tax 50% Cr. ₹ 35,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 85% (7 reviews)

Lets complete the financial statements based on the given ratios and information i Net Profit to Sales 5 Given the net profit to sales ratio is 5 we c...View the full answer

Answered By

Faith Chebet

In the past two years many of my students have excell with the knowledge I taught them.

0.00

0 Reviews

10+ Question Solved

Related Book For

Corporate Accounting As Per The Companies Act 2013 Including Rules 2014 And 2015

ISBN: 9789352605569

2nd Edition

Authors: M Hanif, A Mukherjee

Question Posted:

Students also viewed these Business questions

-

Ann Carter, Chief Financial Officer of Consolidated Electric Company (Con El), must make a recommendation to Con Els board of directors regarding the firms dividend policy. Con El owns two...

-

List three specific parts of the Case Guide, Objectives and Strategy Section (See below) that you had the most difficulty understanding. Describe your current understanding of these parts. Provide...

-

Truss A-N is loaded with 3 kip loads at joints G, H, and I and is held in static equilibrium by a pin support at L and a short link (which can be treated as a 2-force member) at A. 5 ft FA= C 5 ft 17...

-

Bank Teller Staffing Plan As the teller supervisor at Montana Federal Credit Union you are responsible for developing a staffing plan for tellers that meets customer needs, satisfies the union...

-

Case Development began operations in December 2011. When property is sold on an installment basis, Case recognizes installment income for financial reporting purposes in the year of the sale. For tax...

-

Identity four reasons why a merchandise inventory that is larger than needed may decrease the net income of a business?

-

For the first 50 years of business, the Johnson Carpet Company produced carpets for residential use. The salesforce was structured geographically. In the past five years, a large percentage of carpet...

-

The comparative balance sheet for Mosaic Travel Services, Inc., for December 31, 2014 and 2013, is as follows: The following information is taken from the records of Mosaic Travel Services, Inc.: a....

-

Equity Investments, Readily Determinable Fair Value. (14 points) Pugh Company purchased 1,800 shares of the Kramer Group common stock for $64,800 6.c. 536 per share) at the beginning of the current...

-

The Balance Sheet of Pilcom Ltd. for the last 3 years read as below (all figures in lakhs): Sales excludes excise duty and sales tax at 20%. Calculate for the years 2015 and 2016: (i) Fixed Assets...

-

From the following information of Sakoor Ltd., for the year ending 31st March, 2016 examine the details from the point of view of (i) Solvency position (ii) Profitability position. Also comment on...

-

A U.S. designer specifies SAE 4140 steel for a machine component. Name the alloy designation if the same component were to be produced in: (a) Germany; (b) The United Kingdom; (c) The European Union;...

-

1. (5 pts) Given y[n]= 2y[n-1] and y[0]=2, Write MATLAB code to calculate and plot y for 0

-

F ( t ) = t 4 + 1 8 t 2 + 8 1 2 , g ( t ) = ( t + 3 ) / 3 ; find ( f o g ) ( 9 )

-

How did they calculate allocated cost FLIGHT A FLIGHT 350 615 FLIGHT 3 1 Go GALS 20 G EXISTING SCHEME, DETERMINE THE OVE OR FLIGHTS A, B, AND C. 2 ED AT 7.00 PER K1.00 OF PILOT SALAF TOTAL NON-SALARY...

-

High Tech ManufacturingInc., incurred total indirect manufacturing labor costs of $540,000. The company is labor-intensive. Total labor hours during the period were 5,000. Using qualitativeanalysis,...

-

Start with AS/AD and IS/MP in full employment equilibrium. Assume the is a massive positive aggregate demand shock. How would this affect AS/AD and IS/MP and prices and output relative to the full...

-

Should a 31-year-old self-employed single woman establish a traditional deductible IRA, a traditional nondeductible IRA, or a Roth IRA? She has two children, ages 10 and 8.

-

Assume Eq. 6-14 gives the drag force on a pilot plus ejection seat just after they are ejected from a plane traveling horizontally at 1300 km/h. Assume also that the mass of the seat is equal to the...

-

Cougar Corporation owns 1,000 shares of Western Corporation common stock, which it purchased on March 8, 2011, for $12,000. On October 3, 2017, Cougar purchases an additional 300 shares for $3,000....

-

During the current year, Troy sells land to Berry Corporation for $165,000. Troy purchased the land for investment in 2002 for $170,000. Berry Corporation is owned as follows: Owner Percentage...

-

PIB Partnership is owned 20% by Sara, 40% by Steve, and 40% by Thann. Burnham, Inc. is owned 70% by PIB Partnership, 10% by Ralph, 10% by Thann, and 10% by Sara. Ralph and Thann are brothers. All...

-

1,600 Balance Sheet The following is a list (in random order) of KIP International Products Company's December 31, 2019, balance sheet accounts: Additional Paid-In Capital on Preferred Stock $2,000...

-

Question 3 4 pts 9 x + 3 x 9 if x 0 Find a) lim f(x), b) lim, f(x), C), lim , f(x) if they exist. 3 Edit View Insert Format Tools Table : 12pt M Paragraph B IV A2 Tv

-

Mr. Geoffrey Guo had a variety of transactions during the 2019 year. Determine the total taxable capital gains included in Mr. Guo's division B income. The transactions included: 1. On January 1,...

Study smarter with the SolutionInn App