An all-equity firm is considering the following projects: The T-bill rate is 4 percent and the expected

Question:

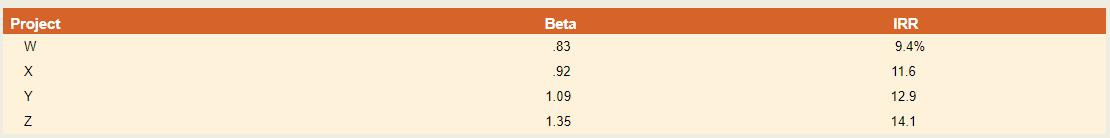

An all-equity firm is considering the following projects:

The T-bill rate is 4 percent and the expected return on the market is 12 percent.

a. Which projects have a higher expected return than the firm’s 12 percent cost of capital?

b. Which projects should be accepted?

c. Which projects would be incorrectly accepted or rejected if the firm’s overall cost of capital was used as a hurdle rate?

Transcribed Image Text:

Project 3 x > Ν Beta 1.09 1.35 IRR 9.4% 11 6 129 141

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 53% (15 reviews)

a Projects Y and Z b Using the CAPM to consider the projects ...View the full answer

Answered By

Joseph Mwaura

I have been teaching college students in various subjects for 9 years now. Besides, I have been tutoring online with several tutoring companies from 2010 to date. The 9 years of experience as a tutor has enabled me to develop multiple tutoring skills and see thousands of students excel in their education and in life after school which gives me much pleasure. I have assisted students in essay writing and in doing academic research and this has helped me be well versed with the various writing styles such as APA, MLA, Chicago/ Turabian, Harvard. I am always ready to handle work at any hour and in any way as students specify. In my tutoring journey, excellence has always been my guiding standard.

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Corporate Finance

ISBN: 9781260772388

13th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

Question Posted:

Students also viewed these Business questions

-

An all-equity firm is considering the following projects: The T-bill rate is 5 percent, and the expected return on the market is 13 percent. (a) Which projects have a higher expected return than the...

-

A manufacturing firm is considering the following mutually exclusive alternatives: Determine which project is a better choice at MARR = 15% on the basis of the IRR criterion. Net Cash Flow Project B...

-

SML and WACC an all equity firm is considering the following projects: The T-bill rate is 5 percent, and the expected return on the market is 12 percent. a. Which projects have a higher expected...

-

The management accountant is preparing the master budget for her retail firm. The following information has been supplied Sales $300,000 Opening inventory $40,000 Closing inventory $60,000 Required...

-

An article by J. J. Pignatiello, Jr. and J. S. Ramberg in the Journal of Quality Technology (Vol. 17, 1985, pp. 198- 206) describes the use of a replicated fractional factorial to investigate the...

-

What proof do you have that individual differences matter in computer training?

-

What is Galloway Companys equity ratio? a. 2.5.78% b. 100.00% c. 34.74% d. 74.22% e. 137.78% GALLOWAY COMPANY Balance Sheet December 31, 2013 Assets Cash..... $ 86,000 Accounts receivable 76,000...

-

1. Although a very detailed change proposal may prevent people from making their own connections, as discussed in the case, it may lead others to consider the proposal vague and unfinished. How do...

-

explain how lack of job opportunities for graduated students is relevant in Fiji pacfic countries?

-

A uniform plane wave in air with H = 4 sin (wt 5x) ay A/m is normally incident on a plastic region with the parameters = o, = 4o, and = 0. (a) Obtain the total electric field in air. (b) Calculate...

-

You have recently been hired by Master Tools (MT) in its relatively new treasury management department. MT was founded eight years ago by Martha Masters. Martha found a method to streamline the...

-

What is the relationship between the one-factor model and the CAPM?

-

Fuel and air enter the combustion chamber of Fig. 12.25 at 25 8 C, and the products exit at the same temperature. Determine the enthalpy of combustion if the fuel is a) CH4 (g), b) C3 H8 (g), c) C8...

-

Encouraging you to sit back and watch a full hour of one of your favorite shows on prime-time television. However, instead of getting up during the commercial break or fast forwarding through the...

-

A family member has been recently diagnosed with a heart condition that requires replacing a heart valve. She points out that if she goes to India, the surgery cost is about 60% cheaper on average...

-

Based on the case of Bowers Machine Parts. Critically analyze why people were not doing their best and critically explain why hiring a consultant might solve the issue. Justify your answer by using...

-

Identify a few strategies for sustainability effectiveness. Should sustainability be a corporation's top priority? Why or why not? What are the challenges associated with implementing sustainable...

-

Answer the following questions for the topic you want to write about. Type your answers in a separate Word document. What is the issue or debatable idea you might write about? What is debatable about...

-

Use shifts and scalings to graph the given functions. Then check your work with a graphing utility. Be sure to identify an original function on which the shifts and scalings are performed. p(x) = x 2...

-

Use the following data to answer the next two (2) questions: Product 1 Product 2 Product 3 Direct Material Cost $25,000 $30,000 $35,000 Direct Labor Cost $30,000 $40,000 $50,000 Direct Labor Hours...

-

What are the implications of the efficient markets hypothesis for investors who buy and sell stocks in an attempt to "beat the market"?

-

Aerotech, an aerospace technology research firm, announced this morning that it hired the world's most knowledgeable and prolific space researchers. Before today, Aerotech's stock had been selling...

-

Aerotech, an aerospace technology research firm, announced this morning that it hired the world's most knowledgeable and prolific space researchers. Before today, Aerotech's stock had been selling...

-

The following amounts were reported on the December 31, 2022, balance sheet: Cash $ 8,000 Land 20,000 Accounts payable 15,000 Bonds payable 120,000 Merchandise inventory 30,000 Retained earnings...

-

Sandhill Co. issued $ 600,000, 10-year, 8% bonds at 105. 1.Prepare the journal entry to record the sale of these bonds on January 1, 2017. (Credit account titles are automatically indented when the...

-

Based on the regression output (below), would you purchase this actively managed fund with a fee of 45bps ? Answer yes or no and one sentence to explain why.

Study smarter with the SolutionInn App