An all-equity firm is considering the following projects: The T-bill rate is 3.5 percent, and the expected

Question:

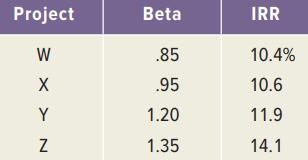

An all-equity firm is considering the following projects:

The T-bill rate is 3.5 percent, and the expected return on the market is 11 percent.

a. Which projects have a higher expected return than the firm’s 11 percent cost of capital?

b. Which projects should be accepted?

c. Which projects would be incorrectly accepted or rejected if the firm’s overall cost of capital was used as a hurdle rate?

Project Beta IRR W .85 10.4% .95 10.6 Y 1.20 11.9 1.35 14.1

Step by Step Answer:

a Projects Y and Z b Using the CAPM to consider the projects we ...View the full answer

Corporate Finance Core Principles And Applications

ISBN: 9781260571127

6th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Related Video

The internal rate of return, or IRR, is a metric used to measure the profitability of an investment. It is the discount rate that makes the net present value of an investment equal to zero. To calculate the IRR, we need to know the investment\'s cash flows. These are the inflows and outflows of cash that will result from the investment. For example, an investment in a property might have cash outflows for the purchase price, closing costs, and any renovations, and cash inflows from rent and eventual sale of the property. The IRR is the discount rate at which the NPV of the investment is equal to zero. There are many ways to calculate IRR, from simple spreadsheet functions to more complex financial modeling software. It\'s worth noting that IRR can be a bit tricky when it comes to projects that don\'t have a consistent cash flow over time. These types of investments are known as \"irregular cash flow\" and the IRR might be misleading or not suitable to calculate. There are other metrics to evaluate these investments such as Modified Internal Rate of Return (MIRR) which is a variation of IRR and is used to get more accurate results.

Students also viewed these Business questions

-

A manufacturing firm is considering the following mutually exclusive alternatives: Determine which project is a better choice at MARR = 15% on the basis of the IRR criterion. Net Cash Flow Project B...

-

SML and WACC an all equity firm is considering the following projects: The T-bill rate is 5 percent, and the expected return on the market is 12 percent. a. Which projects have a higher expected...

-

Alison is an interior designer with her own business. She does not have an office as she thinks it would just be a waste of money as her clients do not come to her, but she goes to the clients. It is...

-

A ball of mass 0.440 kg moving east( + x direction) with a speed of 3.30m/s collides head-on with a 0.220-kg ball at rest. If the collision is perfectly elastic, what will be the speed and direction...

-

Pollsters regularly conduct opinion polls to determine the popularity rating of the current president. Suppose a poll is to be conducted tomorrow in which 2,000 individuals will be asked whether the...

-

I:11-52 Change of Accounting Method. Dana manages real estate and is a cash method taxpayer. She changes to the accrual method in 2023. Danas business income for 2023 is $30,000 computed on the...

-

Discuss the idea that the public sector should accumulate surpluses to cater for future financial distress situations.

-

To assess the efficacy of different liquids for cooling an object of given size and shape by forced convection it is convenient to introduce figure of merit, FF, which combines the influence of an...

-

A project has the following characteristics Activity B D E F G H 1 J K L M N Preceding Activity None A B D D D B C.E G F,I,J HG M Expected Completion Time (in weeks) 5 2 6 12 10 9 5 9 1, 2 3 9 7 8 5...

-

Pacifico Company, a U.S.-based importer of beer and wine, purchased 1,000 cases of Oktoberfeststyle beer from a German supplier for 50,000 euros. Relevant U.S. dollar exchange rates for the euro are...

-

Suppose your company needs $45 million to build a new assembly line. Your target debt-equity ratio is .45. The flotation cost for new equity is 7 percent, but the flotation cost for debt is only 3...

-

Brodsky Metals Corporation has 8.1 million shares of common stock outstanding and 150,000 5.8 percent semiannual bonds outstanding, par value $1,000 each. The common stock currently sells for $41 per...

-

What is a coattail provision ?

-

Repeat Prob. 10-18 for signed-magnitude binary numbers. Prob. 10-18 Derive an algorithm in flowchart form for the comparison of two signed binary numbers when negative numbers are in signed-2's...

-

Tideview Home Health Care, Inc., has a bond issue outstanding with eight years remaining to maturity, a coupon rate of 10 percent with interest paid annually, and a par value of $1,000. The current...

-

Captain Billy Whirlywhirl Hamburgers issued 7%, 10-year bonds payable at 70 on December 31, 2010. At December 31, 2012, Captain Billy reported the bonds payable as follows: Captain Billy Whirlywhirl...

-

Two scenarios about the future of the global economy in 2050 have emerged. Known as continued globalization, the first scenario is a (relatively) rosy one. Spearheaded by Goldman Sachs, whose...

-

Visit www.pearsonglobaleditions.com/malhotra to read the video case and view the accompanying video. Nike: Associating Athletes, Performance, and the Brand highlights Nike's use of marketing research...

-

In problem use (12) to find the general solution of the given differential equation on (0, ). x 2 y'' + xy' + + (36x 2 )y = 0

-

6. (Potential Energy and Conservation of Energy) What should be the spring constant k of a spring designed to bring a 1200-kg car to rest from a speed of 95 km/h so that the occupants undergo a...

-

Fhloston Manufacturing uses 1,860 switch assemblies per week and then reorders another 1,860. If the relevant carrying cost per switch assembly is $6.25, and the fixed order cost is $730, is the...

-

The Trektronics store begins each week with 675 phasers in stock. This stock is depleted each week and reordered. If the carrying cost per phaser is $73 per year and the fixed order cost is $340,...

-

The Harrington Corporation is considering a change in its cash-only policy. The new terms would be net one period. Based on the following information, determine if Harrington should proceed or not....

-

1. Determine the value of the right to use asset and lease liability at commencement of the lease.

-

Problem 22-1 The management of Sunland Instrument Company had concluded, with the concurrence of its independent auditors, that results of operations would be more fairly presented if Sunland changed...

-

Question 4. - Week 9. What are the major competitive issues General Electric faces when managing cooperative strategies? - (7 marks)

Study smarter with the SolutionInn App