Asset W has an expected return of 8.8 percent and a beta of .85. If the risk-free

Question:

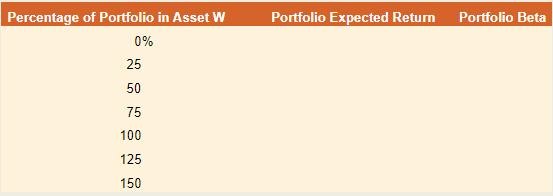

Asset W has an expected return of 8.8 percent and a beta of .85. If the risk-free rate is 2.6 percent, complete the following table for portfolios of Asset W and a risk-free asset. Illustrate the relationship between portfolio expected return and portfolio beta by plotting the expected returns against the betas. What is the slope of the line that results?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance

ISBN: 9781260772388

13th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

Question Posted: