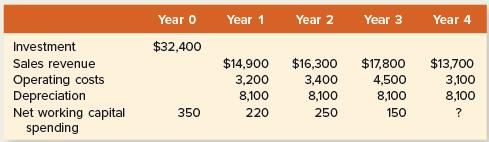

The Fancy Manufacturing Company is considering a new investment. Financial projections for the investment are tabulated here.

Question:

The Fancy Manufacturing Company is considering a new investment. Financial projections for the investment are tabulated here. The corporate tax rate is 22 percent. Assume all sales revenue is received in cash, all operating costs and income taxes are paid in cash, and all cash flows occur at the end of the year. All net working capital is recovered at the end of the project.

a. Compute the incremental net income of the investment for each year.

b. Compute the incremental cash flows of the investment for each year.

c. Suppose the appropriate discount rate is 12 percent. What is the NPV of the project?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance

ISBN: 9781260772388

13th Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe

Question Posted: