Assume that in the original Ityesi example in Table 22.3 , all sales actually occur in Canada

Question:

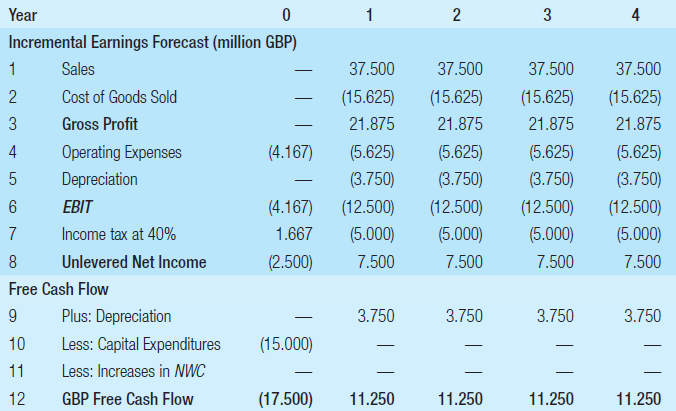

Table 22.3

Expected Foreign Free Cash Flows from Ityesi€™s U.K. Project

Year 1 4 Incremental Earnings Forecast (million GBP) 37.500 Sales 37.500 37.500 37.500 (15.625) Cost of Goods Sold (15.625) (15.625) (15.625) Gross Profit 21.875 21.875 21.875 21.875 Operating Expenses (5.625) 4 (4.167) (5.625) (5.625) (5.625) (3.750) Depreciation (3.750) (3.750) (3.750) (12.500) EBIT (4.167) (12.500) (12.500) (12.500) (5.000) Income tax at 40% 1.667 (5.000) (5.000) (5.000) (2.500) 7.500 7.500 Unlevered Net Income 7.500 7.500 Free Cash Flow Plus: Depreciation 3.750 3.750 3.750 3.750 10 Less: Capital Expenditures (15.000) 11 Less: Increases in NWC (17.500) 11.250 12 GBP Free Cash Flow 11.250 11.250 11.250 3. 2.

Step by Step Answer:

Plan Compute the free cash flows of the project and calculate their net present value Execute The so...View the full answer

Fundamentals of Corporate Finance

ISBN: 978-0321818171

2nd Canadian edition

Authors: Jonathan Berk, Peter DeMarzo, Jarrad Harford

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

Assume that in the original Ityesi example in Table 23.2, all sales actually occur in the United States and are projected to be $60 million per year for four years. Keeping other costs the same,...

-

Assume that in the original Ityesi example in Table 31.1, all sales actually occur in the United States and are projected to be $60 million per year for four years. Keeping other costs the same,...

-

The company for which you work recently implemented time-driven activity-based costing (TDABC) in conjunction with its ERP system. Management is pleased with the revised product and customer cost...

-

Currently, the unit selling price of a product is $220, the unit variable cost is $180, and the total fixed costs are $312,000. A proposal is being evaluated to increase the unit selling price to...

-

Wong Company, a sole proprietorship owned by V. Wong, uses special journals and a general journal. The company uses a perpetual inventory system and had the following transactions: Sept. 2 Sold...

-

Discuss centralization versus decentralization in purchasing. What are the advantages of each?

-

A proposal evaluation sheet is an example of a(n) . a. RFP b. NPV analysis c. earned value analysis d. weighted scoring model LO.1

-

Sanville Quarries is considering acquiring a new drilling machine that is expected to be more efficient than the current machine. The project is to be evaluated over four years. The initial outlay...

-

Example 7: X Ltd. is a company having its shares quoted in major stock exchanges. Its share current market price after dividend distributed at the rate of 20% per annum having a paid up shares...

-

Bonds 1. Municipal Bonds - Municipal bonds are haircut per Exhibit 1 based on both their time to maturity and scheduled maturity at date of issue. 2. Corporate Bonds - Corporate bonds are haircut...

-

You are a Canadian investor who is trying to calculate the present value of a 5 million EUR cash inflow that will occur one year in the future. The spot exchange rate is S 5 1.25 CAD/EUR and the...

-

What discount rate should be used for the incremental lease cash flows to compare a true tax lease to borrowing?

-

Oxygen in a rigid tank with 1 kg is at 160 K, 4 MPa. Find the volume of the tank by iterations using the RedlichK wong EOS. Compare the result with the ideal gas law.

-

Hardwick Corporation manufactures fine furniture for residential and industrial use. The demand for the company's products has increased tremendously in the past three years. As a result, the company...

-

Problem 3: Use the product rule to find the following derivatives. Leave your answer in the form f'(x)g(x)+ f (x) g' (r). That is, do not simplify. (a) s(t)=t3 cos (t) (b) F(y): = (12-1) (v + 5 y)...

-

Do an internet search of two or three organizations in your field of study (Human Resources). Review the organization or business and its hiring practices using some of the questions from the...

-

4. A process was set to meet the design specifications of USL = 26 and LSL = 18. The standard deviation of the process was found to be 1.2. The process mean was set to 22.5. a) Calculate the process...

-

Evaluate the broad environment, e.g., political, social, legal, in which the industry of OCSIP is located. How does this affect the industry?

-

What specific action could a manager take to try to move employees up the employee engagement continuum for example, from not engaged to actively engaged?

-

When you weigh yourself on good old terra firma (solid ground), your weight is 142 lb. In an elevator your apparent weight is 121 lb. What are the direction and magnitude of the elevator's...

-

Kokomochi is considering the launch of an advertising campaign for its latest dessert product, the Mini Mochi Munch. Kokomochi plans to spend $5 million on TV, radio, and print advertising this year...

-

Does accelerated depreciation generally increase or decrease NPV relative to straight line depreciation?

-

You have a depreciation expense of $500,000 and a tax rate of 21%. What is your depreciation tax shield?

-

Question 7 of 7 0/14 W PIERDERY Current Attempt in Progress Your answer is incorrect Buffalo Corporation adopted the dollar value LIFO retail inventory method on January 1, 2019. At that time the...

-

Cost of debt with fees . Kenny Enterprises will issue a bond with a par value of $1,000, a maturity of twenty years, and a coupon rate of 9.9% with semiannual payments, and will use an investment...

-

Assume that an investment of $100,000 is expected to grow during the next year by 8% with SD 20%, and that the return is normally distributed. Whats the 5% VaR for the investment? A. $24,898 B....

Study smarter with the SolutionInn App