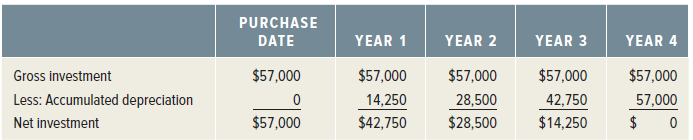

Your firm is considering purchasing a machine with the following annual, end-of-year, book investment accounts. The machine

Question:

The machine generates, on average, $5,800 per year in additional net income.

a. What is the average accounting return for this machine?

b. What three flaws are inherent in this decision rule?

PURCHASE YEAR 1 YEAR 2 DATE YEAR 3 YEAR 4 Gross investment Less: Accumulated depreciation Net investment $57,000 28,500 $57,000 14,250 $42,750 $57,000 $57,000 $57,000 57,000 42,750 $14,250 $57,000 $28,500

Step by Step Answer:

a The average accounting return is the average project earnings after taxes divided by the average b...View the full answer

Corporate Finance Core Principles and Applications

ISBN: 978-1259289903

5th edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe, Bradford Jordan

Related Video

Depreciation of non-current assets is the process of allocating the cost of the asset over its useful life. The cost of the asset includes the purchase price, any additional costs incurred to bring the asset to its current condition and location, and any other costs that are directly attributable to the asset. The useful life of the asset is the period over which the asset is expected to be used by the company. To calculate the depreciation, companies use different methods such as straight-line, declining-balance, sum-of-the-years\'-digits, units-of-production, and group depreciation. The chosen method will depend on the type of asset, the company\'s accounting policies, and the accounting standards that are applicable. The straight-line method allocates an equal amount of the asset\'s cost over its useful life, while the declining-balance method calculates depreciation at a fixed rate, typically double the straight-line rate, but the amount of depreciation decreases over time. The sum-of-the-years\'-digits method is similar to the declining-balance method, but the rate of depreciation is calculated using a fraction that is based on the useful life of the asset. It\'s important to note that the depreciation expense will be recorded on the company\'s income statement and the accumulated depreciation will be recorded on the company\'s balance sheet. This will decrease the value of the asset on the balance sheet over time.

Students also viewed these Business questions

-

A firm is considering purchasing a machine that costs $65,000. It will be used for six years, and the salvage value at that time is expected to be zero. The machine will save $35,000 per year in...

-

Your firm is considering purchasing some computers. Each computer costs $2,600, and each will add to your net revenue by known amounts. Because you plan to use the computers for different purposes,...

-

A corporation is considering purchasing a machine that will save $150,000 per year before taxes. The cost of operating the machine (including maintenance) is $30,000 per year. The machine will be...

-

MVP Company issued a callable bond. The bond is a 7% semiannual coupon bond currently priced at 102 that has a remaining time to maturity of seven years. The bond is callable beginning the end of...

-

Cool Rays Ltd. is considering dropping its Tinted Glass product line. The Tinted Lens product line income statement for the last year was as follows: The company has a total of 3 product lines. Only...

-

Abateer company provides interior design services for residential and commercial customers. Assume Abateer entered into the following contracts during the year: 1. A contract with a family renovating...

-

How did government intervention evolve between the first and second halves of the twentieth century? LO.1

-

Gwen Jones owns and operates GJ Transport Co. During the past year, Gwen incurred the following costs related to an 18-wheel truck: 1. Changed engine oil. 2. Installed a television in the sleeping...

-

SQU Corporation manufactures 5 products to local market in Muscat. The following are the firm's costing data: Net Operating Income 2019 Under Variable Costing) OMR84 400 OMR87,900 Net Operating...

-

Gold nanoparticles (Figure 16-29) can be titrated with the oxidizing agent TCNQ in the presence of excess of Br to oxidize Au(0) to AuBr in deaerated toluene. Gold atoms in the interior of the...

-

An investment project has annual cash inflows of $4,300, $4,900, $5,400, and $5,600, and a discount rate of 12 percent. What is the discounted payback period for these cash flows if the initial cost...

-

The Patches Group has invested $27,000 in a high-tech project lasting three years. Depreciation is $8,100, $12,400, and $6,500 in Years 1, 2, and 3, respectively. The project generates earnings...

-

A company must decide which optical scanner to purchase. Four suppliers are under consideration. The companys purchasing manager has collected the following information from the four suppliers. Given...

-

Explain the principles of database normalization and denormalization, delineating their respective roles in optimizing data storage efficiency, query performance, and data integrity in relational...

-

Asymptotic Computational Complexity O(): Calculate the time complexity of each function below and explain your reasoning. Write your answers on paper and submit a scanned copy. (5 pts each) def...

-

Happy Valley Software has developed a new meteorology software package that will likely revolutionize the weather forecasting industry. They are looking to market the software to the following three...

-

Please read the essay Nasty Women Have Much Work To Do from Alexandra Petri on pages 45-47. In your discussion post, please share your thoughts on what specific strategies she uses to create tone and...

-

We live in an increasingly hyper-competitive global marketplace, where firms are fighting to stay lean and flexible in an effort to satisfy increasingly diverse and specialized consumer demand. In...

-

Multiply or divide as indicated. 5. -30

-

What is your opinion of advertising awards, such as the Cannes Lions, that are based solely on creativity? If you were a marketer looking for an agency, would you take these creative awards into...

-

Southern California Publishing Company is trying to decide whether to revise its popular textbook, Financial Psychoanalysis Made Simple. The company has estimated that the revision will cost...

-

You're prepared to make monthly payments of $240, beginning at the end of this month, into an account that pays 10 percent interest compounded monthly. How many payments will you have made when your...

-

You want to borrow $96,000 from your local bank to buy a new sailboat. You can afford to make monthly payments of $1,950, but no more. Assuming monthly compounding, what is the highest APR you can...

-

Comfort Golf Products is considering whether to upgrade its equipment Managers are considering two options. Equipment manufactured by Stenback Inc. costs $1,000,000 and will last five years and have...

-

Weaver Corporation had the following stock issued and outstanding at January 1, Year 1: 71,000 shares of $10 par common stock. 8,500 shares of $60 par, 6 percent, noncumulative preferred stock. On...

-

Read the following case and then answer questions On 1 January 2016 a company purchased a machine at a cost of $3,000. Its useful life is estimated to be 10 years and then it has a residual value of...

Study smarter with the SolutionInn App