In practice, bonds issued in the United States usually make coupon payments twice a year. So, if

Question:

In practice, bonds issued in the United States usually make coupon payments twice a year. So, if an ordinary bond has a coupon rate of 14 percent, the owner will receive a total of $140 per year, but this $140 will come in two payments of $70 each.

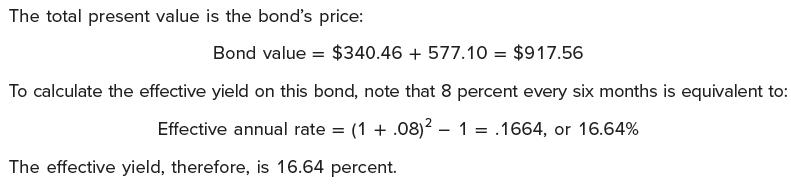

Suppose the yield to maturity on our bond is quoted at 16 percent. Bond yields are quoted as annual percentage rates (APRs); the quoted rate is equal to the actual rate per period multiplied by the number of periods. With a 16 percent quoted yield and semiannual payments, the true yield is 8 percent per six months. If our bond matures in seven years, what is the bond’s price? What is the effective annual yield on this bond?

Based on our discussion, we know the bond will sell at a discount because it has a coupon rate of 7 percent every six months when the market requires 8 percent every six months. So, if our answer exceeds $1,000, we know that we have made a mistake.

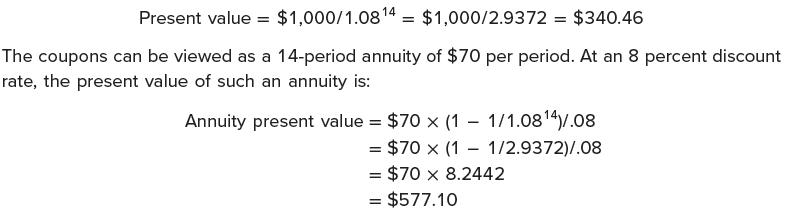

To get the exact price, we first calculate the present value of the bond’s face value of $1,000 paid in seven years. This seven-year period has 14 periods of six months each. At 8 percent per period, the value is:

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe