It is 31 January 2009 and the managers of Dilbert are considering a change in the companys

Question:

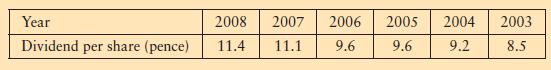

It is 31 January 2009 and the managers of Dilbert are considering a change in the company’s dividend policy. Earnings per share for 2008 for the company were 22.8 pence, and the finance director has said that he expects this to increase to 25.0 pence per share for 2009. The increase in earnings per share is in line with market expectations of the company’s performance. The pattern of recent dividends, which are paid each year on 31 December, is as follows:

The managing director has proposed that 70 per cent of earnings in 2005 and subsequent years should be retained for investment in new product development. It is expected that, if this proposal is accepted, the dividend growth rate will be 8.75 per cent.

Dilbert’s cost of equity capital is estimated to be 12 per cent.

Calculate the share price of Dilbert in the following circumstances.

(a) The company decides not to change its current dividend policy.

(b) The company decides to change its dividend policy as proposed by the Managing Director and announces the change to the market.

Step by Step Answer:

Corporate Finance Principles And Practice

ISBN: 9780273725343

5th Edition

Authors: Denzil Watson, Antony Head