Mr Magoo is planning to invest 18m in one of two short-term portfolios. Both portfolios consist of

Question:

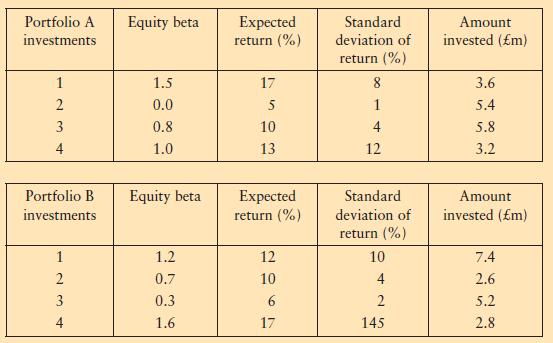

Mr Magoo is planning to invest £18m in one of two short-term portfolios. Both portfolios consist of four short-term securities from diverse industries. The correlation between the returns of the individual securities is thought to be close to zero.

(a) The financial advisor of Mr Magoo has suggested that he uses the capital asset pricing model (CAPM) to compare the portfolios. The current equity risk premium return is estimated to be 5.5 per cent and the yield on short-dated Treasury Bills is 4.5 per cent. Using the information above, recommend which one of the two portfolios should be selected.

(b) Briefly explain whether the capital asset pricing model and portfolio theory use the same measure of risk. In the light of your response, discuss whether you consider portfolio theory or the capital asset pricing model to be most appropriate when choosing between the portfolios in part (a).

Step by Step Answer:

Corporate Finance Principles And Practice

ISBN: 9780273725343

5th Edition

Authors: Denzil Watson, Antony Head