Professional Artworks, Inc., is a firm that speculates in modern paintings. The manager is thinking of buying

Question:

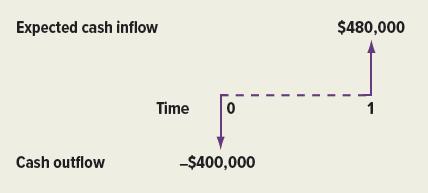

Professional Artworks, Inc., is a firm that speculates in modern paintings. The manager is thinking of buying an original Picasso for $400,000 with the intention of selling it at the end of one year. The manager expects that the painting will be worth $480,000 in one year. The relevant cash flows are depicted in Figure 4.3. Cash Flows for Investment in Painting

Of course, this is only an expectation—the painting could be worth more or less than $480,000. Suppose the guaranteed interest rate granted by banks is 10 percent. Should the firm purchase the piece of art?

Our first thought might be to discount at the interest rate, yielding:

Because $436,364 is greater than $400,000, it looks at first glance as if the painting should be purchased. However, 10 percent is the return one can earn on a riskless investment. Because the painting is quite risky, a higher discount rate is called for. The manager chooses a rate of 25 percent to reflect this risk. In other words, he argues that a 25 percent expected return is fair compensation for an investment as risky as this painting.

The present value of the painting becomes:

At this interest rate, the painting is overpriced at $400,000 and the manager should not make the purchase.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe