Diane Badame, a financial analyst at Kaufman & Broad, a leading real estate firm, is thinking about

Question:

Diane Badame, a financial analyst at Kaufman & Broad, a leading real estate firm, is thinking about recommending that Kaufman & Broad invest in a piece of land that costs $85,000.

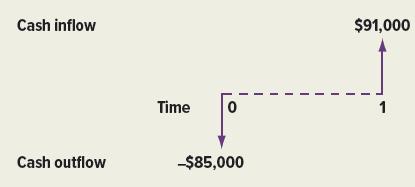

She is certain that next year the land will be worth $91,000, a sure $6,000 gain. Given that the interest rate in similar alternative investments is 10 percent, should Kaufman & Broad undertake the investment in land? Diane’s choice is described in Figure 4.2 with the cash flow timeline.

A moment’s thought should be all it takes to convince her that this is not an attractive business deal. By investing $85,000 in the land, she will have $91,000 available next year. Cash Flows for Land Investment

Suppose, instead, that Kaufman & Broad puts the same $85,000 into alternative investments.

At the interest rate of 10 percent, this $85,000 would grow to:![]()

next year.

It would be foolish to buy the land when investing the same $85,000 in similar alternative investments would produce an extra $2,500 (that is, $93,500 from the bank minus $91,000 from the land investment). This is a future value calculation.

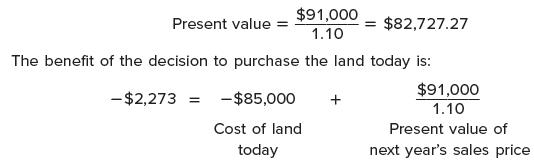

Alternatively, she could calculate the present value of the sale price next year as:

Because the present value of next year’s sales price is less than this year’s purchase price of $85,000, present value analysis also indicates that she should not recommend purchasing the property.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe