Question:

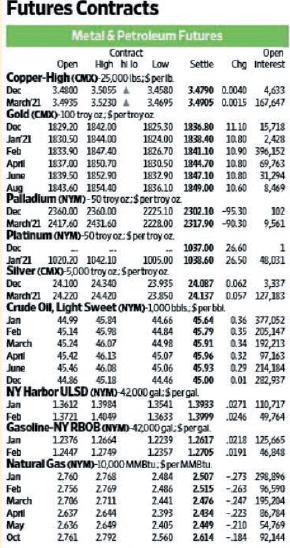

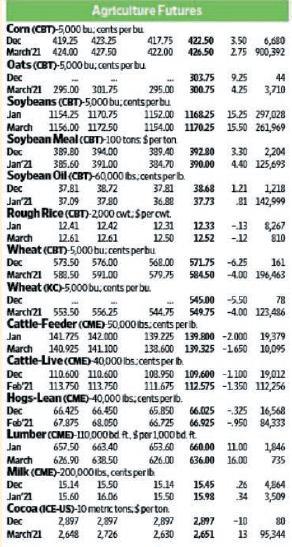

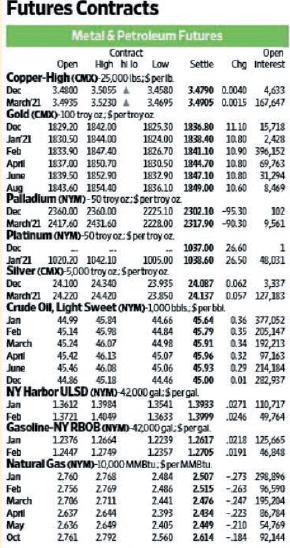

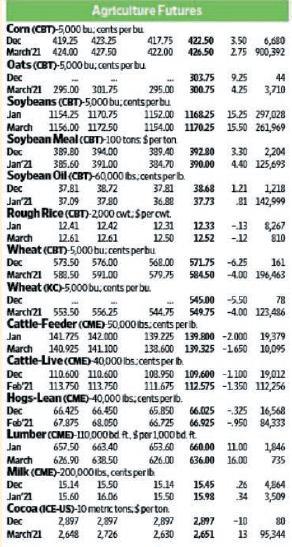

Refer to Table 25.2 in the text to answer this question. Suppose today is December 4, 2020, and your firm produces breakfast cereal and needs 180,000 bushels of corn in March 2021 for an upcoming promotion. You would like to lock in your costs today because you are concerned that corn prices might go up between now and March.

a. How could you use corn futures contracts to hedge your risk exposure? What price would you effectively be locking in based on the closing price of the day?

b. Suppose corn prices are $4.53 per bushel in March. What is the profit or loss on your futures position? Explain how your futures position has eliminated your exposure to price risk in the corn market.

Transcribed Image Text:

Futures Contracts

Metal & Petroleum Futures

Contract

Open High hilo Low

Copper-High (CMX) 25,000 lbs:$perlb

3.4800 3.5055

Dec

3.4580

3.4695

March 21 3.4935 3.5230 A

Gold (CMX)-100 troy oz. $ pertroy oz

Doc

1829.20 1842.00

1830.50 1844.00

Jan 21

Feb

Apri

June

Aug

1833.90 1847.40

1837.00 1850.70

1839.50 1852.90

1843.60 1854.40

Palladium (NYM)-50 troy oz:$pertroy oz

2360.00 2360.00

Dec

2225.10

March 21 2417.60 2431.60

2228.00

Platinum (NYM)-50 troy oz: 5per troy oz.

Doc

Jan 21 1020.20 1042.10

1005.00

Silver (CMX)-5,000 troy oz. $pertroy oz

Dec 24.100 24.340

23.935

23.850

Jan

Feb

March

Jan

Feb

45.42

46.13

45.46 46.08

13612 1.3984

1.3721 1.4049

Jan

Feb

March

Apri

May

Oct

March 21 24.220 24420

Crude Oil, Light Sweet (NYM)-1000 bbls.Sporbbl

44.99 45.84

45.14

45.98

45.24

46.07

1.2376 1.2664

1.2447 1.2749

1825.30

15,718

2,428

1824.00 1838.40

1826.70 1841.10

10.90 396,152

1830.50 1844.70 10.80 69,763

1832.90 1847.10 10.80 31,294

1836.10 1849.00 10.60 8,469

-

2760 2768

2.756 2769

2.706

2711

2637 2644

44.66

44.84

44.98

2636 2.649

2761 2,792

Apri

45.07

June

45.06

Dec

44.86 45.18

44.46

NY Harbor ULSD (NYM)-42000 gal: $ per gal

Jan

13541 1.3933

Feb

13633

Natural Gas (NYM)-10,000 MMBtu. Sper

2.484

2.486

2.441

2.393

Open

Settle Chg Interest

3.4790 0.0040

4,633

3.4905 0.0015 167,647

1.2239

12357

1836.80 11.10

10.80

2.405

2.560

2302.10 -95.30 102

2317.90 -90.30

9,561

Gasoline-NY RBOB (NYMD-42000 gal:Spergal

1037.00 26.60

1038.60 26.50

24.087 0.062 3,337

24.137 0.057 127,183

45.64 0.36 377,052

45.79

45.91

1

48,031

45.96

45.93

45.00

0.35 205,147

0.34 192,213

0.32 97,163

0.29 214,184

0.01 282,937

0271 110,717

1.3999 0246 49,764

1.2617 0218 125,665

1.2705 0191 46,848

MMBtu

2.507 -273 298,896

2.515

-263 96,590

2476

247 195,204

2.434

-223 86,784

2.449

-210

54,769

2.614 -184 92,144