Suppose the Moulton Company has outstanding 1,000 shares of common stock and 100 bonds. Each bond has

Question:

Suppose the Moulton Company has outstanding 1,000 shares of common stock and 100 bonds. Each bond has a face value of $1,000 at maturity. They are discount bonds and pay no coupons. At maturity, each bond can be converted into 10 shares of newly issued common stock.

What circumstances will make it advantageous for the holders of Moulton convertible bonds to convert to common stock at maturity?

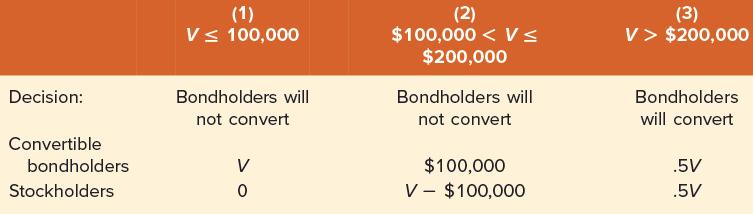

If the holders of the convertible bonds convert, they will receive 100 × 10 = 1,000 shares of common stock. Because there were already 1,000 shares, the total number of shares outstanding becomes 2,000 upon conversion. Converting bondholders own 50 percent of the value of the firm, V. If they do not convert, they will receive $100,000 or V, whichever is less. The choice for the holders of the Moulton bonds is obvious: They should convert if 50 percent of V is greater than $100,000. This will be true whenever V is greater than $200,000. This is illustrated as follows:

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe