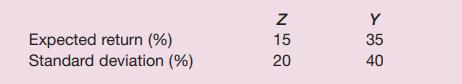

The shares of companies Z and Y have the following expected returns and standard deviations: If the

Question:

The shares of companies Z and Y have the following expected returns and standard deviations:

If the correlation coefficient between the two securities is +0.25, calculate the expected return and standard deviation for the following portfolios:

(a) 100 per cent Z;

(b) 75 per cent Z and 25 per cent Y;

(c) 50 per cent Z and 50 per cent Y;

(d) 25 per cent Z and 75 per cent Y;

(e) 100 per cent Y.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance Principles And Practice

ISBN: 9781292450940

9th Edition

Authors: Denzil Watson, Antony Head

Question Posted: