The Trojan Pizza Company is contemplating investing $1 million in four new outlets in Los Angeles. Andrew

Question:

The Trojan Pizza Company is contemplating investing $1 million in four new outlets in Los Angeles. Andrew Lo, the firm’s chief financial officer (CFO), has estimated that the investments will pay out cash flows of $200,000 per year for nine years at the end of each year and nothing thereafter. Andrew has determined that the relevant discount rate for this investment is 15 percent. This is the rate of return that the firm can earn on comparable projects.

Should the Trojan Pizza Company make the investments in the new outlets?

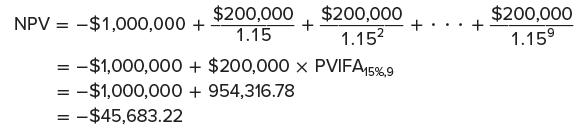

The decision can be evaluated as follows:

The present value of the four new outlets is only $954,316.78. The outlets are worth less than they cost. The Trojan Pizza Company should not make the investment because the NPV is −$45,683.22. If the Trojan Pizza Company requires a 15 percent rate of return, the new outlets are not a good investment.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe