The Water Products Company has a corporate tax rate, TC, of 21 percent and expected earnings before

Question:

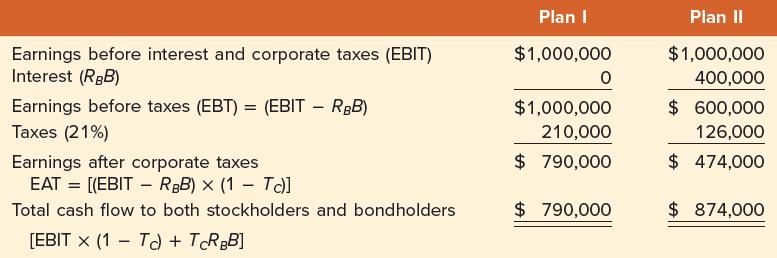

The Water Products Company has a corporate tax rate, TC, of 21 percent and expected earnings before interest and taxes (EBIT) of $1 million each year. Its entire earnings after taxes are paid out as dividends.

The firm is considering two alternative capital structures. Under Plan I, Water Products would have no debt in its capital structure. Under Plan II, the company would have $4,000,000 of debt, B. The cost of debt, RB, is 10 percent.

The chief financial officer for Water Products makes the following calculations:

The most relevant numbers for our purposes are the two on the bottom line. Dividends, which are equal to earnings after taxes in this example, are the cash flow to stockholders and interest is the cash flow to bondholders.12 Here we see that more cash flow reaches the owners of the firm (both stockholders and bondholders) under Plan II. The difference is $84,000 ( = $874,000 − 790,000 ) . It does not take us long to realize the source of this difference.

The IRS receives less tax under Plan II ($126,000) than it does under Plan I ($210,000).

The difference here is $84,000 (= $210,000 − 126,000).

This difference occurs because the way the IRS treats interest is different from the way it treats earnings going to stockholders.13 Interest totally escapes corporate taxation, whereas earnings after interest but before corporate taxes (EBT) are taxed at the 21 percent rate.

Step by Step Answer:

Corporate Finance

ISBN: 9781265533199

13th International Edition

Authors: Stephen Ross, Randolph Westerfield, Jeffrey Jaffe