Thorne plc is planning to sell a new electronic toy. Non-current assets costing 700,000 would be needed,

Question:

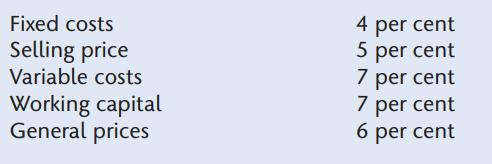

Thorne plc is planning to sell a new electronic toy. Non-current assets costing £700,000 would be needed, with £500,000 payable at once and the balance payable after one year. Initial investment in working capital of £330,000 would also be needed. Thorne expects that, after four years, the toy will be obsolete and the residual value of the non-current assets will be zero. The project would incur incremental total fixed costs of £545,000 per year at current prices, including annual depreciation of £175,000. Expected sales of the toy are 120,000 units per year at a selling price of £22 per toy and a variable cost of £16 per toy, both in current price terms. Thorne expects the following annual increases because of inflation:

If Thorne’s real cost of capital is 7.5 per cent and taxation is ignored, is the project financially acceptable?

Step by Step Answer:

Corporate Finance Principles And Practice

ISBN: 9781292450940

9th Edition

Authors: Denzil Watson, Antony Head