Two companies, A and B, have similar net operating incomes (i.e. gross income less operating expenses) and

Question:

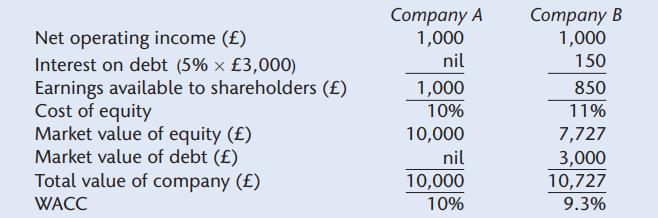

Two companies, A and B, have similar net operating incomes (i.e. gross income less operating expenses) and similar levels of business risk. The only difference is that Company A is not geared, whereas Company B is partly financed by £3,000 of debt with an interest rate of 5 per cent. Financial data for the two companies are as follows:

Company B has a higher cost of equity but a lower overall WACC and a higher market value. This is consistent with the traditional view of capital structure. Miller and Modigliani, however, would argue that, since the two companies have the same business risk and net operating income, they must have the same market values and WACC. Since this is not the case, they would consider Company A to be undervalued and Company B to be overvalued, and that arbitrage will cause the values of the two companies to converge. Using Miller and Modigliani’s assumptions, which imply that companies and individuals can borrow at the same rate, we can illustrate how an investor can make a profit by exploiting the incorrect valuations of the two companies.

Step by Step Answer:

Corporate Finance Principles And Practice

ISBN: 9781292450940

9th Edition

Authors: Denzil Watson, Antony Head