1. 3. Calculating payoffs [LO 24.1] Use the option quote information shown here for NAB to answer...

Question:

1. 3.

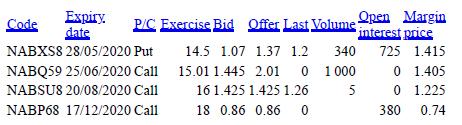

Calculating payoffs [LO 24.1] Use the option quote information shown here for NAB to answer the questions that follow. The shares are currently selling for $15.58.

1.

1. Suppose you buy 10 contracts of the NABSU8 20/08/20 call option.

How much will you pay, ignoring commissions?

2. In part (a), suppose that NAB shares are selling for $19 per share on the expiration date. How much is your options investment worth?

What if the terminal share price is $14? Explain.

3. Suppose you buy 10 contracts of the NABXS8 28/05/2020 put option.

What is your maximum gain? On the expiration date, NAB is selling for $12 per share. How much is your options investment worth? What is your net gain?

4. In part (c), suppose you sell 10 of the NABXS8 28/05/2020 put contracts. What is your net gain or loss if NAB is selling for $11 at expiration? For $19? What is the break-even price—that is, the terminal share price that results in a zero profit?

Step by Step Answer:

Fundamentals Of Corporate Finance

ISBN: 9781743768051

8th Edition

Authors: Stephen A. Ross, Rowan Trayler, Charles Koh, Gerhard Hambusch, Kristoffer Glover, Randolph W. Westerfield, Bradford D. Jordan