2. 8. Cash versus shares as payment [LO 26.3] Consider the following pre-merger information about a bidding

Question:

2. 8.

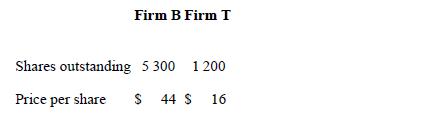

Cash versus shares as payment [LO 26.3] Consider the following pre-merger information about a bidding firm (Firm B) and a target firm

(Firm T). Assume that both firms have no debt outstanding.

1.

Firm B has estimated that the value of the synergistic benefits from acquiring Firm T is $9 300.

1. If Firm T is willing to be acquired for $19 per share in cash, what is the NPV of the merger?

2. What will the price per share of the merged firm be assuming the conditions in (a)?

3. In part (a), what is the merger premium?

4. Suppose Firm T is agreeable to a merger by an exchange of shares. If B offers one of its shares for every two of T’s shares, what will the price per share of the merged firm be?

5. What is the NPV of the merger assuming the conditions in (d)?

Step by Step Answer:

Fundamentals Of Corporate Finance

ISBN: 9781743768051

8th Edition

Authors: Stephen A. Ross, Rowan Trayler, Charles Koh, Gerhard Hambusch, Kristoffer Glover, Randolph W. Westerfield, Bradford D. Jordan