3. 36. Project evaluation [LO 10.1] Aria Acoustics Limited projects unit sales for a new seven-octave voice

Question:

3. 36.

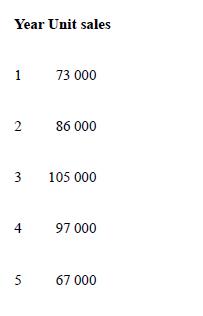

Project evaluation [LO 10.1] Aria Acoustics Limited projects unit sales for a new seven-octave voice emulation implant as follows:

1.

Production of the implants will require $1 500 000 in net working capital to start and additional net working capital investments each year equal to 15 per cent of the projected sales increase for the following year. Total fixed costs are $3 200 000 per year, variable production costs are $255 per unit and the units are priced at $375 each. The equipment needed to begin production has an installed cost of $16 500 000. Because the implants are intended for professional singers, this equipment is considered industrial machinery and thus qualifies for depreciation on a straight-line basis over six years for tax purposes. In five years, this equipment can be sold for about 20 per cent of its acquisition cost. The tax rate is 30 per cent and the required return is 18 per cent. Based on these preliminary project estimates, what is the NPV of the project? What is the IRR?

Step by Step Answer:

Fundamentals Of Corporate Finance

ISBN: 9781743768051

8th Edition

Authors: Stephen A. Ross, Rowan Trayler, Charles Koh, Gerhard Hambusch, Kristoffer Glover, Randolph W. Westerfield, Bradford D. Jordan