5. A measure of risk-adjusted performance that is often used is the Sharpe ratio. The Sharpe ratio...

Question:

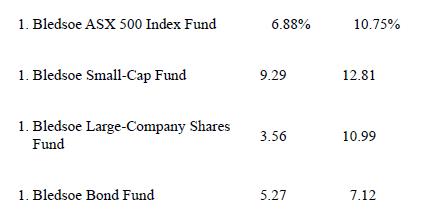

5. A measure of risk-adjusted performance that is often used is the Sharpe ratio. The Sharpe ratio is calculated as the risk premium of an asset divided by its standard deviation. The standard deviation and return of the funds over the past 10 years are listed in the following table. The 10-year average annual risk-free rate is 0.71 per cent. Calculate the Sharpe ratio for each of these funds. Assume that the expected return and standard deviation of the company shares will be 17 per cent and 70 per cent, respectively. Calculate the Sharpe ratio for the company shares. How appropriate is the Sharpe ratio for these assets? When would you use the Sharpe ratio?

Step by Step Answer:

Fundamentals Of Corporate Finance

ISBN: 9781743768051

8th Edition

Authors: Stephen A. Ross, Rowan Trayler, Charles Koh, Gerhard Hambusch, Kristoffer Glover, Randolph W. Westerfield, Bradford D. Jordan