Eyes of the World Corporation has traditionally employed a firmwide discount rate for capital budgeting purposes. However,

Question:

Eyes of the World Corporation has traditionally employed a firm–wide discount rate for capital budgeting purposes.

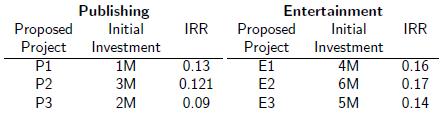

However, its two divisions, publishing and entertainment, have different degrees of risk given by βP = 1 and E = 1.5, where P is the beta for publishing and E the beta for entertainment. The beta for the overall firm is 1.3. The risk free rate is 5% and the expected return on the market is 15%. The firm is considering the following capital expenditures:

1. Which projects would it accept if it uses the opportunity cost of capital for the entire company?

2. Which projects would it accept if it estimates the cost of capital separately for each division?

Step by Step Answer:

Lectures On Corporate Finance

ISBN: 9789812568991

2nd Edition

Authors: Peter L Bossaerts, Bernt Arne Odegaard