In the previous problem, suppose Severn Trent plc has announced it is going to repurchase 1 billion

Question:

In the previous problem, suppose Severn Trent plc has announced it is going to repurchase £1 billion worth of equity. What effect will this transaction have on the equity of the firm? How many shares will be outstanding? What will the price per share be after the repurchase? Ignoring tax effects, show how the share repurchase is effectively the same as a cash dividend.

Data from Previous problem

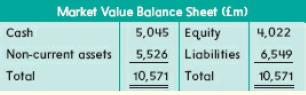

Regular Dividends The balance sheet for Severn Trent plc is shown here in market value terms. There are 2.4 billion shares outstanding.

The company has declared a dividend of £0.40 per share.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Corporate Finance

ISBN: 9780077173630

3rd Edition

Authors: David Hillier, Stephen A. Ross, Randolph W. Westerfield, Bradford D. Jordan, Jeffrey F. Jaffe

Question Posted: