Liquidity How would you rate the liquidity position of Montgomery Organizations plc between 2012 and 2015? Provide

Question:

Liquidity How would you rate the liquidity position of Montgomery Organizations plc between 2012 and 2015? Provide a brief report of the company’s liquidity over time.

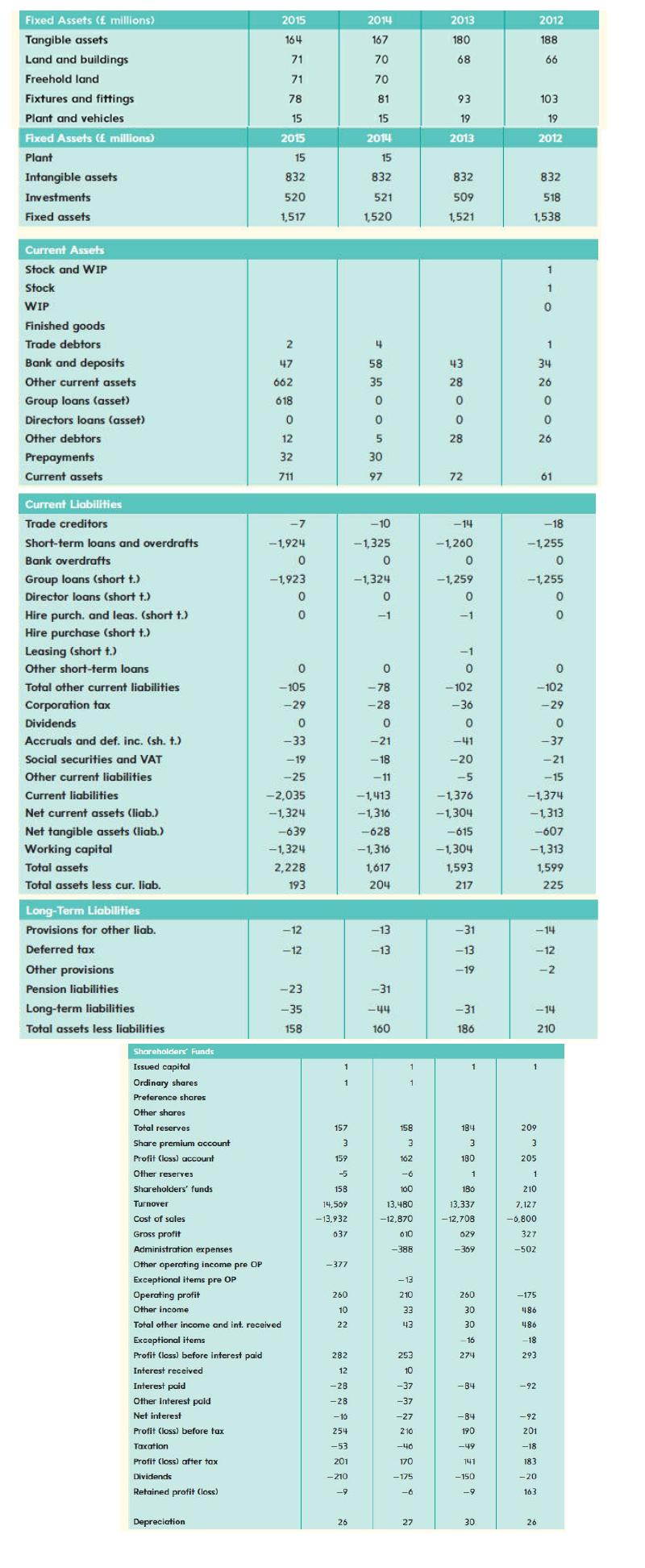

Montgomery Organizations plc, whose annual accounts are given below. The firm has 14,685,856 shares and the share price is £2.78.

Transcribed Image Text:

Fixed Assets ( millions) Tangible assets Land and buildings Freehold land Fixtures and fittings Plant and vehicles Fixed Assets ( millions) Plant Intangible assets Investments Fixed assets Current Assets Stock and WIP Stock WIP Finished goods Trade debtors Bank and deposits Other current assets Group loans (asset) Directors loans (asset) Other debtors Prepayments Current assets Current Liabilities Trade creditors Short-term loans and overdrafts Bank overdrafts Group loans (short t.) Director loans (short t.) Hire purch, and leas. (short t.) Hire purchase (short t.) Leasing (short t.) Other short-term loans Total other current liabilities Corpora Dividends Accruals and def. inc. (sh. t.) Social securities and VAT Other current liabilities Current liabilities Net current assets (liab.) Net tangible assets (liab.) Working capital Total assets Total assets less cur. liab. Long-Term Liabilities Provisions for other liab. Deferred tax Other provisions Pension liabilities Long-term liabilities Total assets less liabilities Shareholders Funds Issued capital Ordinary shares Preference shares Other shares Total reserves Share premium account Profit (loss) account Other reserves 2015 164 71 71 78 15 2015 15 832 520 1,517 Depreciation 2 47 662 618 0 12 32 711 -7 -1,924 0 -1,923 0 0 0 -105 -29 0 -33 -19 -25 -2,035 -1,324 -639 -1,324 2,228 193 -12 -12 Shareholders' funds Turnover Cost of sales Gross profit Administration expenses Other operating income pre OP Exceptional items pre OP Operating profit Other income Total other income and int. received. Exceptional items Profit (loss) before interest paid Interest received Interest paid Other Interest paid Net interest Profit (loss) before tax Taxation Profit (loss) after tax Dividends Retained profit (loss) -23 -35 158 1 1 ******* **** ***** -13,932 26 2014 167 70 70 81 15 2014 15 832 521 1,520 4 58 35 0 0 5 30 97 -10 -1,325 0 -1,324 0 -1 0 -78 -28 0 -21 -18 -11 -1,413 -1,316 -628 -1,316 1,617 204 -13 -13 -31 -44 160 1 1 ******** **** **555*1861 A 13.480 -12,870 2013 180 68 93 19 2013 832 509 1,521 43 28 0 0 28 72 * T F 4 -1,260 -1,259 -102 -1,376 -1,304 -615 -1,304 1,593 217 -31 -13 -19 -31 186 184 3 180 1 180 13,337 -12,708 629 -369 260 30 30 -16 274 -84 -84 190 -49 141 -150 -9 30 832 518 1,538 209 3 205 1 2012 188 66 210 7,127 -6,800 103 19 2012 327 -502 -1,255 0 -1,255 0 0 -175 486 486 -18 293 1 1 0 -102 -29 -92 0 -92 201 -18 183 -20 163 1 -1,374 -1,313 -607 -1,313 1,599 225 26 34 26 0 0 26 -14 -12 -2 61 -14 210 -18 0 -37 -21 -15

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 33% (6 reviews)

Answered By

Charles mwangi

I am a postgraduate in chemistry (Industrial chemistry with management),with writing experience for more than 3 years.I have specialized in content development,questions,term papers and assignments.Majoring in chemistry,information science,management,human resource management,accounting,business law,marketing,psychology,excl expert ,education and engineering.I have tutored in other different platforms where my DNA includes three key aspects i.e,quality papers,timely and free from any academic malpractices.I frequently engage clients in each and every step to ensure quality service delivery.This is to ensure sustainability of the tutoring aspects as well as the credibility of the platform.

4.30+

2+ Reviews

10+ Question Solved

Related Book For

Corporate Finance

ISBN: 9780077173630

3rd Edition

Authors: David Hillier, Stephen A. Ross, Randolph W. Westerfield, Bradford D. Jordan, Jeffrey F. Jaffe

Question Posted:

Students also viewed these Business questions

-

How would you rate the long-term solvency position of Montgomery Organizations plc between 2012 and 2015? Provide a brief report of the companys long-term solvency over time. Montgomery Organizations...

-

What is the profitability of Montgomery Organizations plc like over the period 2012 and 2015? Provide a brief report of the companys profitability over time. Do profitability ratios give a good...

-

How efficient have Montgomery Organizations plcs operations been during 2015? Provide a brief report of the companys asset efficiency over time. Montgomery Organizations plc, whose annual accounts...

-

You drive 1 2 miles on your way to college campus and it takes' you 2 5 minutes. Before you park your car, you realize that you forgot your wallet. You immediately return home via the same route of 1...

-

if you invest $10,525 today at an interest rate of 7.35% compounded daily, how much money will you have on your saving account in 15 years?

-

QUESTION 15 You plan to borrow $150,000 from the bank to pay for inventories for your small business. The bank offers to lend you the money at 6 percent annual interest for the 4 months the funds...

-

Menu A restaurant offers a $12 dinner special that has 5 choices for an appetizer, 10 choices for entres, and 4 choices for dessert. How many different meals are available if you select an appetizer,...

-

Many organizations focus their strategy on providing high-quality customer service and consequently place metrics concerning customer relationship management on their balanced scorecards. Consider...

-

The central issue of efficient market concerns: O regulations O information O participants structure

-

Provide an overview on the companys relative market valuation over the period 20122015. What can be inferred from the companys relative market valuation? Montgomery Organizations plc, whose annual...

-

Construct common-size statements for Montgomery Organizations plc. Montgomery Organizations plc, whose annual accounts are given below. The firm has 14,685,856 shares and the share price is 2.78....

-

Solve each problem. If m varies jointly as x and y, and m = 10 when x = 2 and y = 14, find m when x = 21 and y = 8.

-

Factor the expression. 4x+31x+21

-

What was the total cost of Job #1253 for January? * (1 Point) BREAD Co. is a print shop that produces jobs to customer specifications. During January 2019, Job #1253 was worked on and the following...

-

The Greensboro Performing Arts Center (GPAC) has a total capacity of 7,600 seats: 2,000 center seats, 2,500 side seats, and 3,100 balcony seats. The budgeted and actual tickets sold for a Broadway...

-

eBook Current position analysis The bond indenture for the 10-year, 9% debenture bonds issued January 2, 2015, required working capital of $100,000, a current ratio of 1.5, and a quick ratio of 1 the...

-

Explain Below terms 1-Leverage Ratios 2-Profitability Ratios 3-Market Value Ratios 4-Liquidity Ratios 5-Efficiency Ratios

-

Cyanoacetic acid, CH2CNCOOH, is used in the manufacture of barbiturate drugs. An aqueous solution containing 5.0 g in a liter of solution has a pH of 1.89. What is the value of Ka?

-

The following processes constitute the air-standard Diesel cycle: 12: isentropic compression,23: constant-volume energy addition (T and P increase),34: constant-pressure energy addition (v...

-

Calculating Taxes The Baryla Co. had $325,000 in 2007 taxable income. Using the rates from Table 2.3 in the chapter, calculate the companys 2007 income taxes.

-

Tax Rates In Problem 6, what is the average tax rate? What is the marginal tax rate?

-

Tax Rates In Problem 6, what is the average tax rate? What is the marginal tax rate?

-

(15 points) Stressed $2.500,000 of S% 20 year bands. These bonds were issued Jary 1, 2017 and pay interest annually on each January 1. The bonds yield 3% and was issued at $325 8S! Required (2)...

-

Packaging Solutions Corporation manufactures and sells a wide variety of packaging products. Performance reports are prepared monthly for each department. The planning budget and flexible budget for...

-

1. A company issued 10%, 10-year bonds with a par value of $1,000,000 on January 1, at a selling price of $885,295 when the annual market interest rate was 12%. The company uses the effective...

Study smarter with the SolutionInn App