How would you rate the long-term solvency position of Montgomery Organizations plc between 2012 and 2015? Provide

Question:

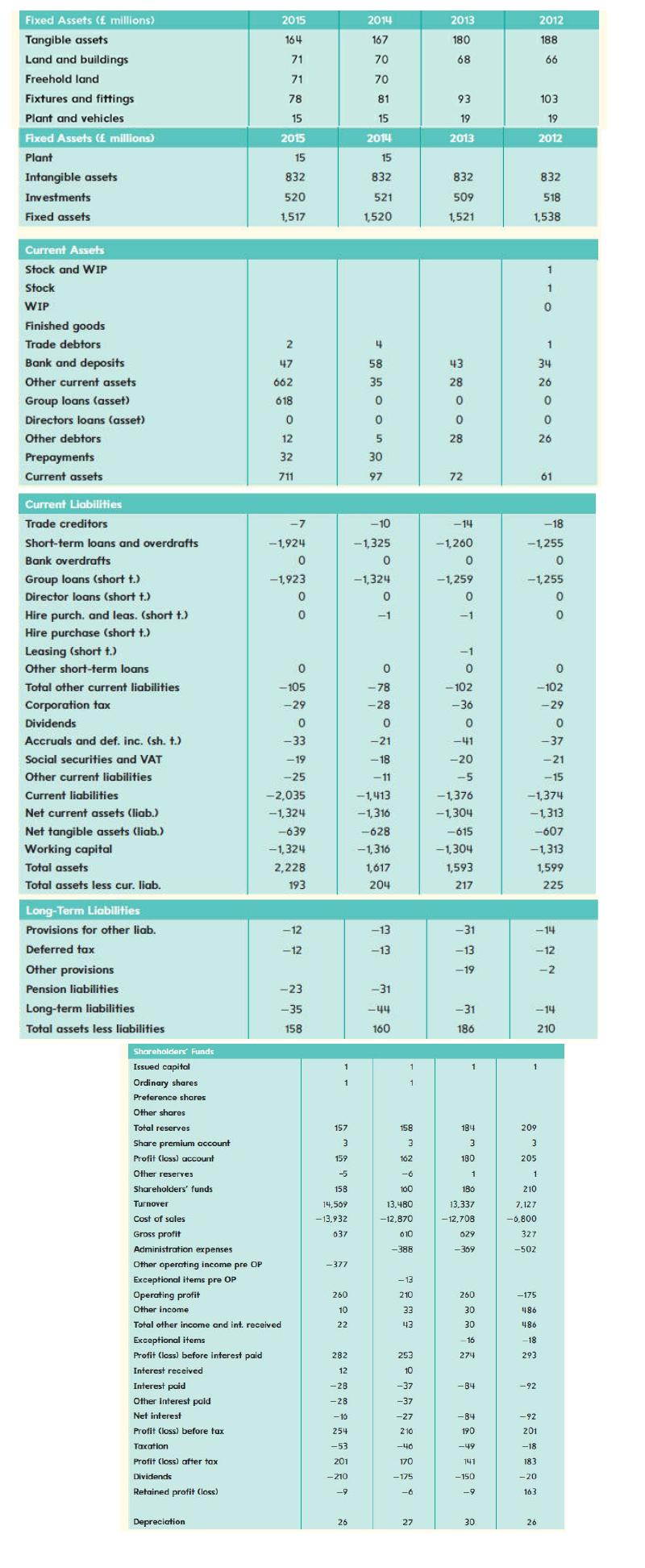

How would you rate the long-term solvency position of Montgomery Organizations plc between 2012 and 2015? Provide a brief report of the company’s long-term solvency over time.

Montgomery Organizations plc, whose annual accounts are given below. The firm has 14,685,856 shares and the share price is £2.78.

Transcribed Image Text:

Fixed Assets ( millions) Tangible assets Land and buildings Freehold land Fixtures and fittings Plant and vehicles Fixed Assets ( millions) Plant Intangible assets Investments Fixed assets Current Assets Stock and WIP Stock WIP Finished goods Trade debtors Bank and deposits Other current assets Group loans (asset) Directors loans (asset) Other debtors Prepayments Current assets Current Liabilities Trade creditors Short-term loans and overdrafts Bank overdrafts Group loans (short t.) Director loans (short t.) Hire purch, and leas. (short t.) Hire purchase (short t.) Leasing (short t.) Other short-term loans Total other current liabilities Corpora Dividends Accruals and def. inc. (sh. t.) Social securities and VAT Other current liabilities Current liabilities Net current assets (liab.) Net tangible assets (liab.) Working capital Total assets Total assets less cur. liab. Long-Term Liabilities Provisions for other liab. Deferred tax Other provisions Pension liabilities Long-term liabilities Total assets less liabilities Shareholders Funds Issued capital Ordinary shares Preference shares Other shares Total reserves Share premium account Profit (loss) account Other reserves 2015 164 71 71 78 15 2015 15 832 520 1,517 Depreciation 2 47 662 618 0 12 32 711 -7 -1,924 0 -1,923 0 0 0 -105 -29 0 -33 -19 -25 -2,035 -1,324 -639 -1,324 2,228 193 -12 -12 Shareholders' funds Turnover Cost of sales Gross profit Administration expenses Other operating income pre OP Exceptional items pre OP Operating profit Other income Total other income and int. received. Exceptional items Profit (loss) before interest paid Interest received Interest paid Other Interest paid Net interest Profit (loss) before tax Taxation Profit (loss) after tax Dividends Retained profit (loss) -23 -35 158 1 1 ******* **** ***** -13,932 26 2014 167 70 70 81 15 2014 15 832 521 1,520 4 58 35 0 0 5 30 97 -10 -1,325 0 -1,324 0 -1 0 -78 -28 0 -21 -18 -11 -1,413 -1,316 -628 -1,316 1,617 204 -13 -13 -31 -44 160 1 1 ******** **** **555*1861 A 13.480 -12,870 2013 180 68 93 19 2013 832 509 1,521 43 28 0 0 28 72 * T F 4 -1,260 -1,259 -102 -1,376 -1,304 -615 -1,304 1,593 217 -31 -13 -19 -31 186 184 3 180 1 180 13,337 -12,708 629 -369 260 30 30 -16 274 -84 -84 190 -49 141 -150 -9 30 832 518 1,538 209 3 205 1 2012 188 66 210 7,127 -6,800 103 19 2012 327 -502 -1,255 0 -1,255 0 0 -175 486 486 -18 293 1 1 0 -102 -29 -92 0 -92 201 -18 183 -20 163 1 -1,374 -1,313 -607 -1,313 1,599 225 26 34 26 0 0 26 -14 -12 -2 61 -14 210 -18 0 -37 -21 -15

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 0% (2 reviews)

Answered By

Branice Buyengo Ajevi

I have been teaching for the last 5 years which has strengthened my interaction with students of different level.

4.30+

1+ Reviews

10+ Question Solved

Related Book For

Corporate Finance

ISBN: 9780077173630

3rd Edition

Authors: David Hillier, Stephen A. Ross, Randolph W. Westerfield, Bradford D. Jordan, Jeffrey F. Jaffe

Question Posted:

Students also viewed these Business questions

-

Liquidity How would you rate the liquidity position of Montgomery Organizations plc between 2012 and 2015? Provide a brief report of the companys liquidity over time. Montgomery Organizations plc,...

-

What is the profitability of Montgomery Organizations plc like over the period 2012 and 2015? Provide a brief report of the companys profitability over time. Do profitability ratios give a good...

-

How efficient have Montgomery Organizations plcs operations been during 2015? Provide a brief report of the companys asset efficiency over time. Montgomery Organizations plc, whose annual accounts...

-

A certain apple bruises if a net force greater than 9 . 5 N is exerted on it . Would a 0 . 1 3 k g apple be likely to bruise if it falls 1 . 8 m and stops after sinking 0 . 0 5 m into the grass?...

-

High Noon Sun, Inc. has a 5 percent, semiannual coupon bond with a current market price of $988.52. The bond has a par value of $1,000 and a yield to maturity of 5.29 percent. How many years is it...

-

Question 10 1 pts Use the following table to answer the question below. If you have the standard utility function described in the lecture with A = 6, and you think the future will be like the...

-

Job Openings A software company is hiring for two positions: a software development engineer and a sales operations manager. How many ways can these positions be filled if there are 12 people...

-

On June 10, 20X8, Tower Corporation acquired 100 percent of Brown Companys common stock. Summarized balance sheet data for the two companies immediately after the stock acquisition are as follows:...

-

Adjusting Entry Journalize the following transaction. Reply to your classmates answers. A . May 1 ABC paid $ 6 0 0 for 6 - month insurance premium. May 3 1 prepare the adjusting entry. B . Jun 6 ABC...

-

Provide an overview on the companys relative market valuation over the period 20122015. What can be inferred from the companys relative market valuation? Montgomery Organizations plc, whose annual...

-

Construct common-size statements for Montgomery Organizations plc. Montgomery Organizations plc, whose annual accounts are given below. The firm has 14,685,856 shares and the share price is 2.78....

-

What recommendations would you make to Gap senior management to improve upon its turnaround strategy? What actions are necessary to restore the competitiveness of its core Gap, Banana Republic, and...

-

Question: Divide.21r7-35r37r3r8-5r43r7-5r33r6-5r221r6-35r2 Divide. 2 1 r7 - 3 5 r3 7r 3r 8 - 5 r4 3 r7 - 5 r3 3 r6 - 5 r2 2 1 r6 - 3 5 r2 Divide. 21r7 - 35r 7r 38-54 3r7-53 3r6-52 216-3512

-

System of Equations: Value of a Value of b 9 a + 3 b = 3 0 8 a + 4 b = 2 8

-

An important practice is to check the validity of any data set that you analyze. One goal is to detect typos in the data, and another would be to detect faulty measurements. Recall that outliers are...

-

ve The re e Problem 3 Complete the following perpetual inventory form. Perpetual Inventory Total Product Name: Purchase Unit Size: Carried Forward: Date In Out 1/7 3 Balance 1/9 1/10 1/12 1/15 2 1 5...

-

the above date, Saloni was admitted in the partnership firm. Raman surrendered th 5 2 of his share and Rohit surrendered th 5 1 of his share in favour of Saloni. It was agreed that : (i) Plant and...

-

A 0.050 M aqueous solution of sodium hydrogen sulfate, NaHSO4, has a pH of 1.73. Calculate Ka2 for sulfuric acid. Sulfuric acid is a strong electrolyte, so you can ignore hydrolysis of the HSO4 ion.

-

Show that the block upper triangular matrix A in Example 5 is invertible if and only if both A 11 and A 22 are invertible. Data from in Example 5 EXAMPLE 5 A matrix of the form A = [ A11 A12 0 A22 is...

-

Dividends and Retained Earnings Suppose the firm in Problem 2 paid out $86,000 in cash dividends. What is the addition to retained earnings?

-

Per-Share Earnings and Dividends suppose the firm in Problem 3 had 30,000 shares of common stock outstanding. What are the earnings per share, or EPS, figure? What are the dividends per share figure?

-

Market Values and Book Values Klingon Widgets, Inc., purchased new cloaking machinery three years ago for $7 million. The machinery can be sold to the Romulans today for $3.7 million. Klingons...

-

Minden Company introduced a new product last year for which it is trying to find an optimal selling price. Marketing studies suggest that the company can increase sales by 5,000 units for each $2...

-

Prepare the adjusting journal entries and Post the adjusting journal entries to the T-accounts and adjust the trial balance. Dresser paid the interest due on the Bonds Payable on January 1. Dresser...

-

Venneman Company produces a product that requires 7 standard pounds per unit. The standard price is $11.50 per pound. If 3,900 units required 28,400 pounds, which were purchased at $10.92 per pound,...

Study smarter with the SolutionInn App