The following transactions were completed by Montague Inc., whose fiscal year is the calendar year: 20Y1 Instructions

Question:

The following transactions were completed by Montague Inc., whose fiscal year is the calendar year:

20Y1 Instructions

Instructions

1. Journalize the entries to record the foregoing transactions.

2. Indicate the amount of the interest expense in (a) 20Y1 and (b) 20Y2.

3. Determine the carrying amount of the bonds as of December 31,20Y2.

Transcribed Image Text:

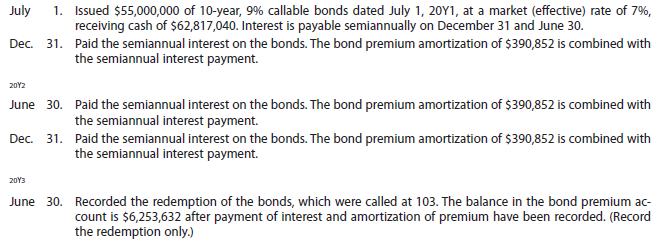

1. Issued $55,000,000 of 10-year, 9% callable bonds dated July 1, 20Y1, at a market (effective) rate of 7%, receiving cash of $62,817,040. Interest is payable semiannually on December 31 and June 30. Dec. 31. Paid the semiannual interest on the bonds. The bond premium amortization of $390,852 is combined with July the semiannual interest payment. 20Y2 June 30. Paid the semiannual interest on the bonds. The bond premium amortization of $390,852 is combined with the semiannual interest payment. Dec. 31. Paid the semiannual interest on the bonds. The bond premium amortization of $390,852 is combined with the semiannual interest payment. 20Y3 June 30. Recorded the redemption of the bonds, which were called at 103. The balance in the bond premium ac- count is $6,253,632 after payment of interest and amortization of premium have been recorded. (Record the redemption only.)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (9 reviews)

1 2 a 20Y1 2084148 b 20Y2 4168296 3 20Y1 July Dec 2...View the full answer

Answered By

User l_906815

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The following transactions were completed by Fullerton Farm Equipment Ltd., a distributor with a June 30 fiscal year-end. Fullerton Farm Equipment Ltd. had the following account balances on February...

-

The following transactions were completed by The Bronze Gallery during the current fiscal year ended December 31: June 6. Reinstated the account of Ian Netti, which had been written off in the...

-

The following transactions were completed by Interia Management Company during the current fiscal year ended December 31: Feb. 24. Received 40% of the $18,000 balance owed by Broudy Co., a bankrupt...

-

Muscles: Identify the name of the muscle, the origin, the insertion, and the action of the muscle labeled on the models. iliopsoas (psoas major and iliacus) gluteus maximus gluteus medius sartorius...

-

Why do nutritionists worry about food security? Who is most likely to suffer from food insecurity?

-

Select the correct answer for each of the following. 1. On December 31, 20X1, Tiffin Township paid a contractor $2,000,000 for the total cost of a new firehouse built in 20X1 on township-owned land....

-

The December 31, 1994, balances in Retained Earnings and Additional Paid-In Capital for Railway Shippers Company are $135,000 and $50,000, respectively. Five thousand, $10 par value common shares are...

-

During normal business hours on the east coast, calls to the toll-free reservation number of the Nite Time Inn arrive at a rate of 5 per minute. It has been determined that the number of calls per...

-

Stock S is expected to return 20% in a boom, 10% in a normal economy, and 5% in a recession. Stock T is expected to return 15% in a boom, 12% in a normal economy, and 8% in a recession. The...

-

The following scenarios present a set of ethical dilemmas that might arise in marketing research. Your assignment is to decide what action to take in each instance. You should be prepared to justify...

-

Bowers Company purchased merchandise on account from Saunders Corp. for $28,000, terms 1/10, n/30. Bowers returned merchandise with an invoice amount of $5,500 and received full credit. a. If Bowers...

-

During the current year, merchandise is sold for $23,680,000. The cost of the goods sold is $13,024,000. a. What is the amount of the gross profit? b. Compute the gross profit percentage (gross...

-

Confirmations of long- term debt provide evidence about which assertions?

-

1. A T-shaped beam with an overhang is supported and loaded as shown in Fig. 1. Draw shear force diagram and calculate (a) the shear stress at a point D, 2 m from support A and 25 mm from the top of...

-

Question 1: Write Specific Case to brief is Flying Fish Bikes, Inc. v. Giant Bicycle, Inc., 181 F.Supp.3d 957? Grading Rubric for Case Brief Written Case Brief 3 (Exceeds Identification - Heading...

-

A local gym is looking in to purchasing more exercise equipment and runs a survey to find out the preference in exercise equipment amongst their members. They categorize the members based on how...

-

A fountain with an opening of radius 0.015 m shoots a stream of water vertically from ground level at 6.0 m/s. The density of water is 1000 kg/m. (a) Calculate the volume rate of flow of water. (b)...

-

35 h/2 21 3 3 2t 3. A thin-walled beam has the cross-section shown in the figure. If the beam is subjected to a bending moment Mx in the plane of the web 23 calculate the direct stress at the points...

-

Suppose you know that a companys stock currently sells for $74 per share and the required return on the stock is 10.6 percent. You also know that the total return on the stock is evenly divided...

-

Explain how two samples can have the same mean but different standard deviations. Draw a bar graph that shows the two samples, their means an standard deviations as error bars. T S

-

What is the purpose of preparing a bank reconciliation?

-

What is the purpose of preparing a bank reconciliation?

-

(a) How are cash equivalents reported in the financial statements? (b) What are some examples of cash equivalents?

-

The market price of a stock is $24.55 and it is expected to pay a dividend of $1.44 next year. The required rate of return is 11.23%. What is the expected growth rate of the dividend? Submit Answer...

-

Suppose Universal Forests current stock price is $59.00 and it is likely to pay a $0.57 dividend next year. Since analysts estimate Universal Forest will have a 13.8 percent growth rate, what is its...

-

ABC Company engaged in the following transaction in October 2 0 1 7 Oct 7 Sold Merchandise on credit to L Barrett $ 6 0 0 0 8 Purchased merchandise on credit from Bennett Company $ 1 2 , 0 0 0 . 9...

Study smarter with the SolutionInn App