Accrual adjustments II We learned about Sun, C and Sand in Chapters 2 and 3. The companys

Question:

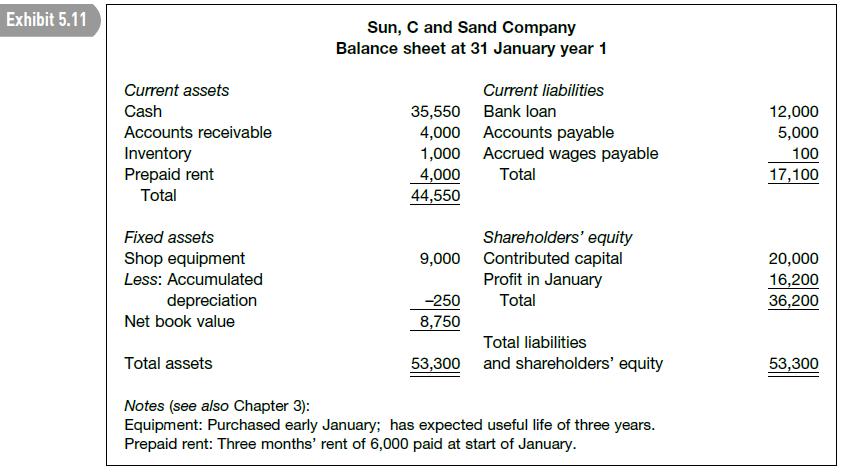

Accrual adjustments II We learned about Sun, C and Sand in Chapters 2 and 3. The company’s balance sheet on 31 January year 1 – the end of its first month of operations – is set out in Exhibit 5.11.

Fred Chopin and Georgie Sand opened a bottle of Cava to celebrate the success of their store in January. February, by contrast, was a disaster. Unseasonably cool, wet weather kept the winter visitors away. Here’s what happened to the business that month:

1 The company made no sales of goods in February. Moreover, the customer who owed 4,000 at the end of January also experienced business problems. After lengthy negotiations the customer signed a six-month note agreeing to pay, at the end of July, the principal of the note plus accrued interest. Interest is to accrue from 1 February at the rate of 1.5% a month.

2 In desperation, Georgie started a monthly magazine for resident foreigners like herself. Remembering the Cava, she decided to call it ‘Grapevine’. The annual subscription was 24, payable in advance.

Five hundred subscriptions were sold in February. The first issue came out at the end of February.

3 The magazine generated 750 of advertising revenue in February (although Sun, C and Sand received no cash from advertisers that month).

4 The costs of printing and distributing the magazine were 3/copy, all paid in cash during the month.

5 Utility costs paid in February were 350, the same as in January.

6 Payments in February to the part-time employee (whose duties now included writing a gossip column, Sotto voce, in the magazine) were 1,200, including 100 of unpaid January wages. In view of his additional duties, the wages earned by him in February were 1,350.

7 Despite the company’s operating difficulties, the amount owing to suppliers at 31 January was paid in February. So too was February’s interest on the 10% bank loan.

8 Adjustments were made in the accounts for the use of shop space and equipment in the month.

There were no other transactions or accounting events in February.

Required

(a) Prepare journal entries to record the above.

(b) Post the entries to ledger accounts.

(c) What is the company’s profit or loss in February?AppenedixLO1

Step by Step Answer: