Assessing financial risk using cash flow data Franz, an analyst at a large insurance company, receives the

Question:

Assessing financial risk using cash flow data Franz, an analyst at a large insurance company, receives the following e-mail from Sylvie, his boss.

‘Can you take a look at Unilever’s financial leverage for me? I’m concerned about the impact of the Bestfoods acquisition in 2000. It played havoc with their balance sheet. Their profitability seems to have recovered in 2001 but their debt levels still look very high.

‘I’m particularly interested in the group’s net debt-to-Ebitda ratio. I read that Procter & Gamble, Unilever’s big rival in the household products market, had a net debt-to-Ebitda ratio of only 1.37 in 2001/02 and it’s been pretty steady in recent years (2000/01: 1.39; 1999/2000: 1.33). How does Unilever compare with P&G on this ratio?

‘There’s another cash flow measure of financial leverage I’d like you to calculate. It’s called the cash flow adequacy ratio – or CFAR. The folks at Fitch, the credit rating agency, devised it.12 It’s calculated as follows:

CFAR = where:

Net free cash flow = Ebitda – Taxes paid – Interest paid – Preference dividends – Capex, net Average annual debt maturities . . . = (Debt principal payments due in next five years)/5 ‘Fitch claims CFAR is a reliable indicator of changes in corporate credit quality. P&G had a CFAR of 2.9 in 2001/02. According to Fitch, that shows financial strength: in effect, the company’s free cash flow covered average debt payments 2.9 times that year.’

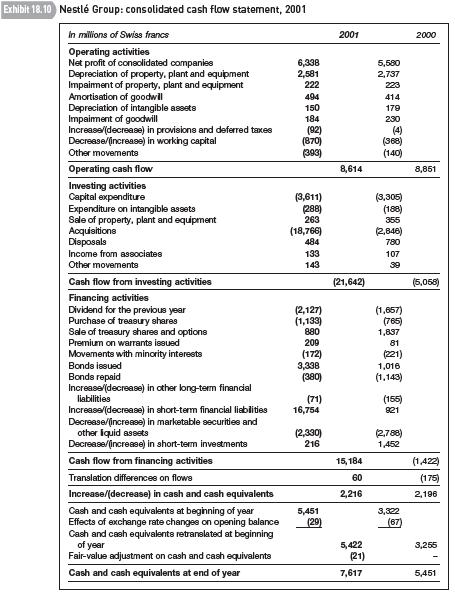

Franz collects income and balance sheet data from the 1999–2001 accounts of the Anglo-Dutch food and household products group (see Exhibit 18.11). In addition, he extracts the following cash flow information from the group’s cash flow statements for these years.

2001 2000 1999 Income taxes paid 1,887 1,734 1,443 Interest paid (net of interest received) 1,651 620 58 Capital expenditures (net of disposals) 957 890 1,249 He’s about to start work on the assignment when he gets called away on another project. He asks you to complete the assignment for him.

Required

(a) Calculate Unilever’s net debt-to-Ebitda and CFAR ratios for each of the three years 1999–2001.

Identify the main reasons for the changes in the two ratios over this time. Do the two ratios send the same signals about the group’s credit quality and changes in it? If not, why not?

(b) Compare the two ratios, net debt-to-Ebitda and CFAR. Which of these ratios, in your opinion, provides a more accurate and reliable measure of a firm’s debt-paying ability – and why?AppenedixLO1

Step by Step Answer: