Detecting earnings manipulation with cash flow data Managers sometimes try to inflate reported corporate earnings using dubious

Question:

Detecting earnings manipulation with cash flow data Managers sometimes try to inflate reported corporate earnings using dubious accounting techniques.

Careful inspection of the cash flow statement may help investors unmask such manipulation.

Consider the following examples.

(1) Unable to persuade customers to pay licensing fees for the use of its technology, SIT Company enters into ‘advertising agreements’ with some of them. Under the agreements, customers agree to carry out certain ‘advertising’ for SIT in exchange for technology licences. The advertising fees charged by the customers match the licensing fees SIT charges them so that SIT (and its customers)

experience no net cash inflow or outflow as a result of the transactions. SIT books the licensing fees as current revenue but defers recognition of the advertising costs. As a result, it reports a profit from the exchange of services.

(2) AC, a carpet retail chain, states that its policy is to recognise revenue on a carpet sale only when the carpet has been delivered and fitted. The customer pays for the carpet before delivery occurs.

As a result of pressure on store management to meet sales targets in a recent year, many stores brought forward the recognition of revenues on carpet sales made in the last two weeks of that year to the date of payment.

(3) B, a pharmaceutical company, normally books revenues when it ships goods to distributors.

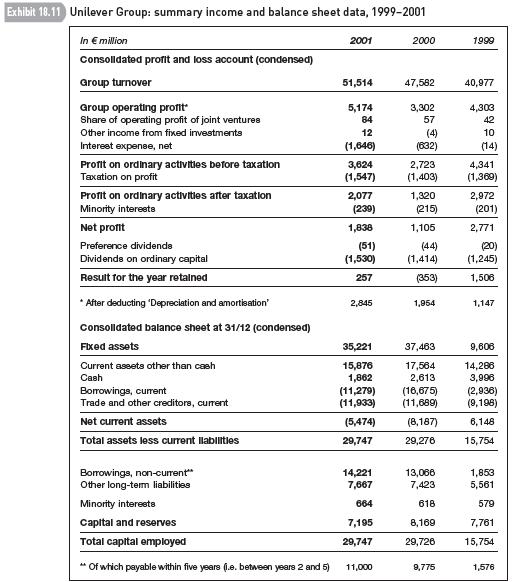

Recently, management became concerned that the company would not be able to meet stock Annual net free cash flow Average annual debt maturities over next 5 years

market expectations about annual sales and earnings growth. It persuaded distributors to increase purchases of its products at the end of its financial year by offering them ‘bill and hold’ terms. Under this policy, a distributor can delay paying for goods it buys. It orders goods from B and has them delivered to its warehouse. However, it pays for them only when they’re shipped at a later date from the warehouse to the final customer (e.g. pharmacy, hospital, clinic). Meanwhile, B recognises revenue on delivery of the goods to the warehouse.

Required Each of the above accounting policies creates a difference between profit and operating cash flow in the period. Identify the account or accounts where the difference appears. How might an investor use information from the cash flow statement to detect the manipulation of earnings in each case?AppenedixLO1

Step by Step Answer: