Construction of a cash flow statement I You are Emil. You have an eye for numbers. Geppetto,

Question:

Construction of a cash flow statement I You are Emil. You have an eye for numbers. Geppetto, a puppet-maker, is troubled and asks for your help. ‘We had a good year last year. After-tax profits were 13 million. How then can our cash have fallen by 2 million? Can you take a look at last year’s accounts and tell me what’s going on? I can’t make head or tail of these accounts and people tell me you’re quite a financial detective when it comes to balance sheets.’

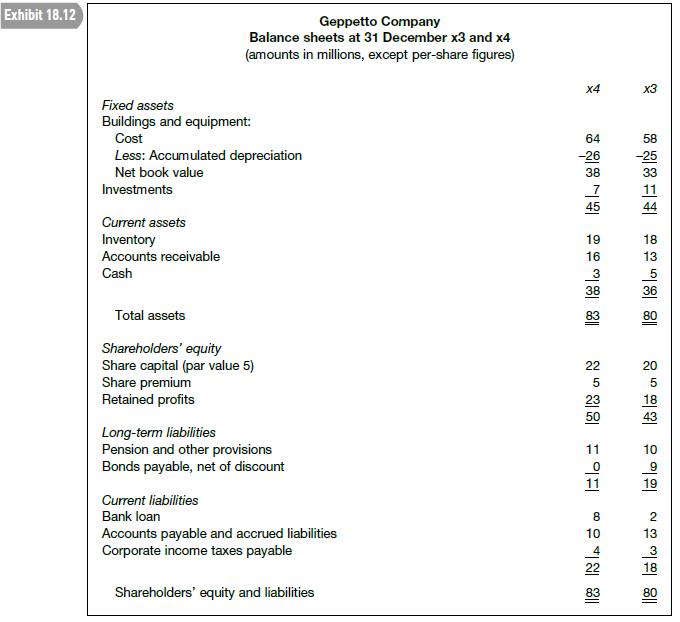

He gives you the balance sheets of the company at 31 December x3 and x4. These are set out in Exhibit 18.12.

In addition, you uncover the following information about the company in x4. (All amounts except per-share figures are in millions.)

1 The company spends 21 on new buildings and equipment. It sells, for 9, fixed assets with a net book value of 11. Depreciation charged in the year is 5.

2 It sells investments with a carrying amount of 4 and reports a gain on sale of 1.5.

3 It pays a cash dividend of 1.5 a share during the year. At the end of the year, it declares and distributes a 10% share dividend to shareholders. There are no other issues of shares in the year.

4 Profit before tax is 20. Income tax expense is 7.

5 The bonds are retired at the start of the year and 9.5 is paid to bondholders.

Required Prepare a cash flow statement for Geppetto Company, showing the flows of cash in x4 by activity.

Draft a brief memo to Geppetto explaining the reason for the decline in cash in the year.AppenedixLO1

Step by Step Answer: