Deferred tax accounting: comprehensive example Tyr Company designs and manufactures military hardware. It has asked you to

Question:

Deferred tax accounting: comprehensive example Tyr Company designs and manufactures military hardware. It has asked you to calculate its income tax expense for x3 and its current and deferred taxes at the end of that year.

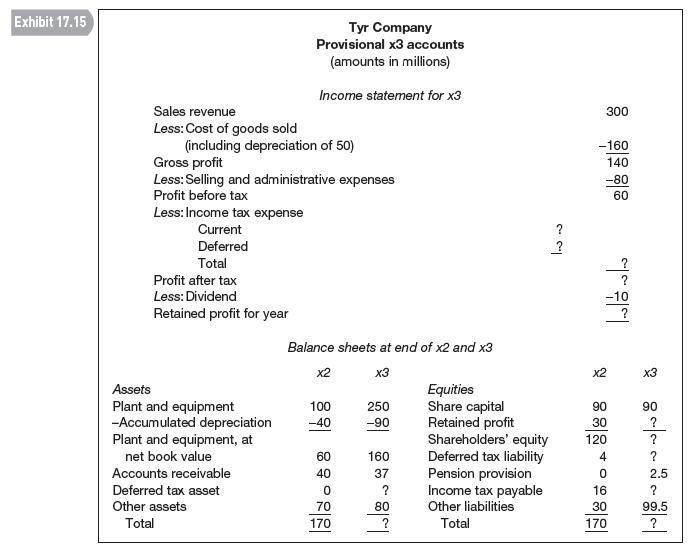

Its provisional x3 accounts (with the exception of the tax and tax-related figures) are set out in Exhibit 17.15. Comparative end-x2 balance sheet numbers are also given.

On enquiry, you learn the following (all amounts are in millions):

l Plant and equipment. The depreciation rate is 20% SL in the books and 25% SL for tax purposes.

The accumulated tax depreciation at the end of x2 is 50. The company purchases plant of 150 in x3. It records a full year’s depreciation in the year of purchase.

l Bribes. The tax authorities have disallowed expenditures of 5 which the company describes in its accounts as ‘Foreign sales commissions’.

l Pension cost. Under a new scheme, the company records pension expense of 14 and makes contributions to the plan of 11.5. Only pension contributions are tax deductible.

l Bad debts. The company makes a general provision for bad debts of 3 at the end of x3. Only bad debt write-offs are tax deductible. There are no bad debt write-offs in x3.

The tax rate is 40%. The company makes tax payments of 15 in x3. The company takes a balance sheet approach when accounting for deferred taxes and accounts for all temporary differences.

Assume that deductible and taxable temporary differences arise in different tax jurisdictions.

Required Complete Tyr’s x3 accounts in Exhibit 17.15. Calculate income tax expense and deferred tax balances using the balance sheet approach.AppenedixLO1

Step by Step Answer: