Income taxes: analysis of disclosures I Sandvik is a large engineering company with headquarters in Sweden. Its

Question:

Income taxes: analysis of disclosures I Sandvik is a large engineering company with headquarters in Sweden. Its high-speed steel tools and mining equipment have a high reputation. Only 5% of its 2001 sales of SEK 48.9 billion (A5.3 billion)

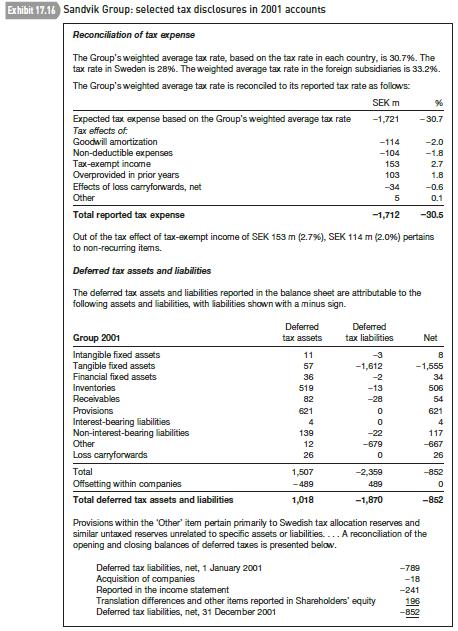

and one-third of its production that year were in its home market. Group profit before tax was SEK 5.6 billion in 2001 (2000: SEK 5.8 billion). Reported tax expense of SEK 1.7 billion in 2001 was broken down in the accounts as follows (negative sign indicates expense or debit):

In SEK million 2001 2000 Current taxes −1,555 −1,662 Adjustment of taxes attributable to prior years 103 −71 Total current tax expense −1,452 −1,733 Deferred tax expense −241 −137 Taxes on participation in associated companies −19 −11 Total reported tax expense −1,712 −1,881 In common with other Swedish multinationals, Sandvik provides detailed information about its current and deferred taxes in its consolidated accounts. (The company follows Swedish GAAP which is similar to IAS in this area.) Exhibit 17.16 contains extracts from the tax note in the consolidated accounts.

Required

(a) Investors use information in the analysis of a company’s effective tax rate to forecast tax expense – and therefore profits – in future years. With the information Sandvik provides, it’s possible to identify the recurring elements in the group’s effective tax rate. Assuming Sandvik’s weighted average (statutory) tax rate remains at 30.7%, estimate its effective tax rate for 2002. State any assumptions you have made.

(b) Sandvik reports a net deferred tax liability of SEK 852 million in its end-2001 consolidated balance sheet. There are four main sources of temporary difference. In addition to ‘Other’ (for which Sandvik provides an explanation), they are:

(i) tangible fixed assets;

(ii) inventories;

(iii) provisions.

Suggest an explanation for each of these three major sources of temporary difference (taxable in the case of tangible fixed assets, deductible in the case of inventories and provisions). Note that the company values its inventories in its published accounts at the lower of FIFO cost or market, an acceptable method of valuation for tax purposes. ‘Provisions’ are long-term in nature and relate mainly to pension benefits and warranties.

(c) Not all the change in the Sandvik’s net deferred tax liabilities in 2001 is reported in the income statement. Part relates to ‘Translation differences and other items reported in Shareholders’

equity’. Give examples of items reported directly in shareholders’ equity that may have a deferred tax effect (besides translation differences).AppenedixLO1

Step by Step Answer: