Financing statement: conversion to cash basis Spanish companies include a financing statement in their published accounts in

Question:

Financing statement: conversion to cash basis Spanish companies include a ‘financing statement’ in their published accounts in place of a cash flow statement. It shows the sources and uses of the company’s funds in the period, where the term

‘funds’ indicates working capital (current assets less current liabilities) rather than cash. The statement can be converted to a cash basis. However, the resulting cash flow statement is approximate since key cash flow numbers (e.g. changes in working capital excluding the effects of acquisitions and disposals of businesses in the year) are not disclosed.

Compañía Logística de Hidrocarburos (CLH) is a company providing logistics services – mainly transport and storage of oil products – in mainland Spain and the Balearic Islands. Key operating data for the 1998–2001 period are given below:

In Bm 2001 2000 1999 1998 Operating revenues 541 517 479 468 Net income 163 124 125 103 The company undertook a financial restructuring in 2001, replacing equity capital with debt.

The aim, according to the company, was to increase returns on equity and thereby attract new shareholders.

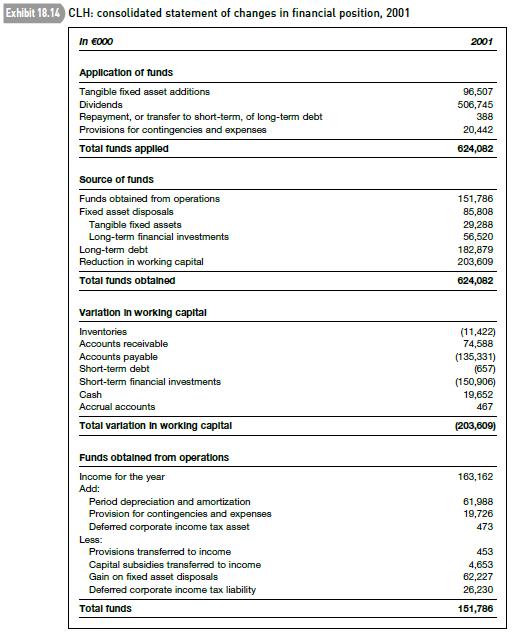

CLH includes a financing statement in its 2001 accounts (see Exhibit 18.14). It describes it in the English-language version of the accounts as a ‘statement of changes in financial position’.

Required

(a) Convert CLH’s 2001 statement of changes in financial position to a cash basis. Analyse cash flows by operating, financing and investing activities. Use the ‘Funds obtained from operations’

figure as the starting point of the ‘Operating activities’ section. This figure is the sum of profit, depreciation and other long-term accruals.

(b) The company reported a major change in its financial balances in 2001 – from net cash of A153.3 million at the end of 2000 to net debt of A161 million a year later.

At 31 December 2001 2000 Short-term financial investments 1.4 152.3 Cash 22.4 2.7

– Long-term debt (183.4) (1.0)

– Short-term debt (1.4) (0.7)

Net cash/(debt) (161.0) 153.3 Using the information in the cash flow statement you prepared in (a), explain the main reasons for the A314.3 million change in CLH’s net financial position in 2001.

Check figure:

(a) Cash flow impact from change (A000)

in operating working capital +71,698.AppenedixLO1

Step by Step Answer: