The cash flow statement: alternative format An investor asks you to explain some features of the cash

Question:

The cash flow statement: alternative format An investor asks you to explain some features of the cash flow statement of Thorntons, a UK confectionery producer and retailer, that puzzle her.

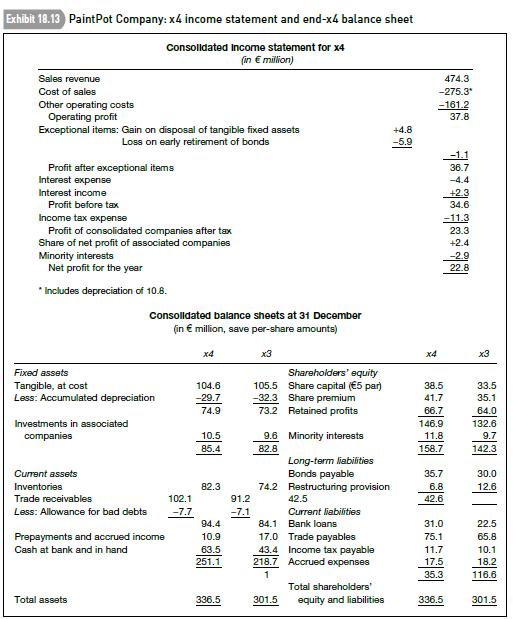

‘Thorntons’ cash flow statement has a strange format. It doesn’t have the usual three-way split of operating, investing and financing cash flows. For example, take the statements for the years to end-

June 2001 and 2002 (see [A] below: all the numbers are in £ millions). I can see an operating cash flow number but where are the investing and financing cash flow subtotals?

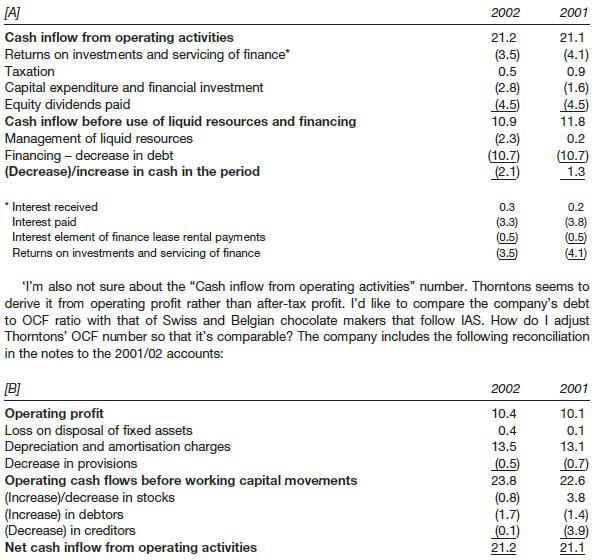

One final point. Thorntons provides a reconciliation of net cash flow to the movement in net debt (see [C] below). I’ve not seen this in IAS-style cash flow statements before. On the face of it, this is a good idea. But the reconciliation makes me doubtful about the reliability of the numbers in the cash flow statement. For example, it shows net debt falling from £52.3 million at the start of 2000/01 to £37.2 million at the end of 2001/02, a decline of only £15.1 million.

[C] 2002 2001 (Decrease)/increase in cash in the period (2.1) 1.3 Cash outflow from decrease in debt 10.7 10.7 Cash outflow/(inflow) from increase/(decrease) in liquid resources 2.3 (0.2)

Change in net debt resulting from cash flows 10.9 11.8 Inception of new finance leases (3.7) (4.1)

Translation difference 0.1 0.1 Movement in net debt in the period 7.3 7.8 Net debt at beginning of period 44.5 52.3 Net debt at end of period 37.2 44.5 ‘But according to the cash flow statement, net debt decreased by £22.7 million over the two years.

Thorntons seems to have excluded the effect of new finance leases from the cash flow statement.

Why have they done this? Surely the finance leases have a cash flow impact?’

Required

(a) Identify the cash flows in [A] that would be shown under ‘Investing activities’ and ‘Financing Activities’ in an IAS-style cash flow statement.

(b) Calculate the operating cash flow number that Thorntons would report in the bottom line of the ‘Operating Activities’ section of an IAS-style cash flow statement.

(c) Explain why Thorntons has excluded new finance leases from financing flows in the cash flow statement.AppenedixLO1

Step by Step Answer: