Profitability: competitor analysis The personal computer (PC) industry has experienced spectacular growth in the last 20 years.

Question:

Profitability: competitor analysis The personal computer (PC) industry has experienced spectacular growth in the last 20 years. It started in the late 1970s when Apple, Atari and Commodore introduced the first personal computers. It took off in 1981 when IBM launched its first PC using an Intel microprocessor and operating software

provided by Microsoft. Worldwide sales grew by over 15% a year throughout the 1990s. By 2000 annual PC sales had reached 130 million units and revenues exceeded US$150 billion that year. The main reasons for the growth in sales were: the accelerating power of PCs; falling unit prices, helped by falling prices for components (which represent 80–85% of a PC’s cost); open standards based on Intel’s microprocessor designs and Microsoft’s operating software; and the impact of the Internet.

Rapid growth in sales has not translated into high profits for PC producers, however. Low barriers to entry have resulted in a fragmented industry – the largest firm holds no more than 15% of the worldwide market. Given the dominance of ‘Wintel’ technology, there’s limited opportunity for product differentiation. Finally, PC producers are in a weak bargaining position relative to their customers (switching costs are low) and component suppliers.

Future prospects look bleak. The bursting of the dotcom bubble and the contraction of business investment in the EU, Japan and the USA saw a fall in unit sales and revenues in 2001 and 2002.

Growth is not expected to resume until 2004. New competitors have established themselves in those markets that are still growing (e.g. China) and plan to invade the more mature western markets.

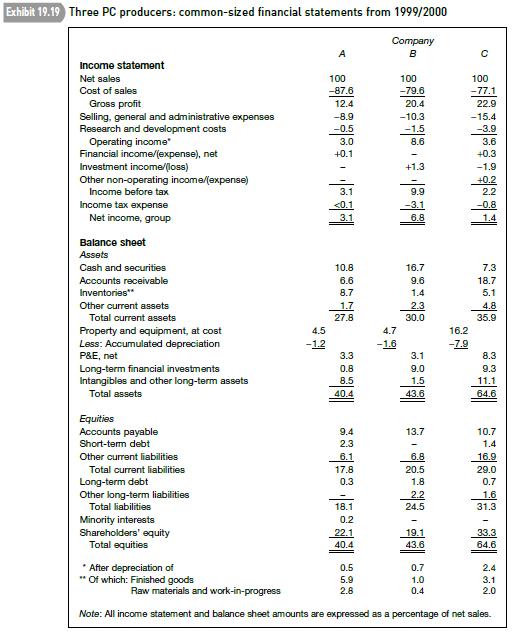

Three of the largest firms in the industry are Compaq (since 2002, part of the Hewlett Packard group), Dell and Legend. All three pursue a ‘cost leadership’ strategy – aiming to produce a similar product to their rivals but at lower cost – but each operationalises it in a different way. Some important characteristics of the three firms are summarised below:

1 Compaq. US company. World’s largest PC producer, with total sales of US$42 billion in 2000.

Founded in early 1980s. Focus on lowering production costs through just-in-time delivery of components and automated assembly lines with low labour content. Has diversified in recent years:

half of 2000 sales consisted of servers and storage products and computer-related services, mainly to businesses.

2 Dell. US company. Founded in early 1980s. Total sales of US$32 billion in 2000. Pioneered direct sales of PCs to final customers. Assembly of PC is begun when customer places order (by phone or Internet).

3 Legend. Chinese company. Sales of US$3.5 billion in 2000. Founded in 1984 as distributor of foreign-made computer products. Began making own line of PCs in 1990. By 1997, largest producer in China. Pursues low price strategy – PC prices are 25% below those of equivalent foreign brands – made possible by reliance on China-sourced materials and components.

Exhibit 19.19 contains three common-sized balance sheets and income statements taken from recent accounts of the three companies.

Required Given the brief information above about the operations and business strategies of Compaq, Dell and Legend, decide which set of accounts belongs to which company. What evidence from the exhibit did you use in making your decision?AppenedixLO1

Step by Step Answer: