Residual income and measuring value creation Michelin, the French tyre manufacturer, provides in its annual report to

Question:

Residual income and measuring value creation Michelin, the French tyre manufacturer, provides in its annual report to shareholders an assessment of its economic performance in the year. Management compare the group’s actual return on capital employed with the target return to determine whether it has created or destroyed value in the period.

The target return on capital is similar in concept to the weighted average cost of capital: Michelin’s was estimated by management to be 10.7% in 2001.

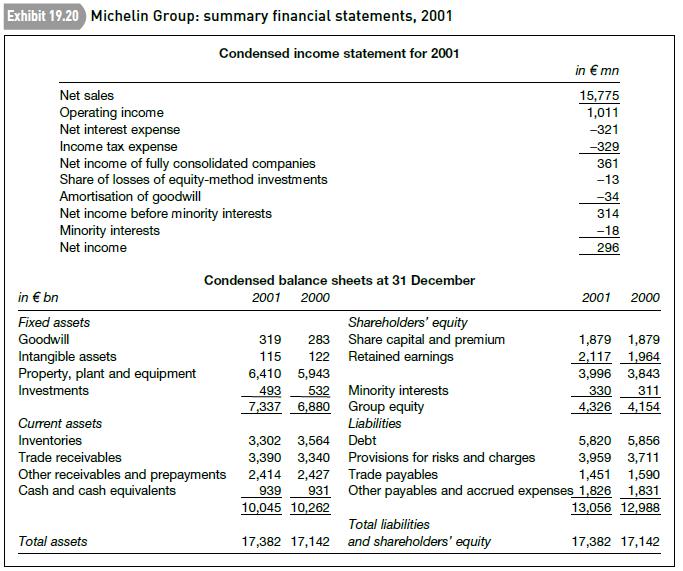

Exhibit 19.20 contains summary income statement and balance sheet information for 2001 for the Michelin Group.

Required

(a) Calculate Michelin’s residual income for 2001. According to your figures, did the group create or destroy value that year? Assume Michelin’s marginal tax rate is 40% in 2001.

(b) In calculating actual and target returns on capital, Michelin include ‘commitments under noncancellable operating leases’ as part of capital employed. Average operating lease commitments in present value terms were A602 million in 2001. Michelin also adjust the profit figure but do not disclose precisely how they do it. Indicate, in general terms, how Michelin’s NOPAT (net operating profit after tax) should be adjusted for the effect of capitalising non-cancellable operating leases when calculating residual income. (There is insufficient information in the exhibit to compute the adjustment.).AppenedixLO1

Step by Step Answer: