Analysis of leverage Deutsche Telekom (DT) is Germanys and Europes largest telecoms group. Investors were

Question:

Analysis of leverage Deutsche Telekom (DT) is Germany’s – and Europe’s – largest telecoms group. Investors were concerned about DT’s finances in 2002. Fierce competition in its home market resulted in a fall in the revenues and profits of its main division, fixed-line services, in 2001. Its other divisions – Systems, Mobile, and Online – all made losses that year and, in the case of Mobile and Online, are not expected to become free-cash-flow positive until the middle of the decade. Debt levels were already high owing to the funding of third-generation mobile licences which cost DT over A15 billion in 2000. They rose further with the acquisition of US wireless operators VoiceStream and Powertel. DT made an initial investment of A5.6 billion in VoiceStream’s preferred stock in September 2000 (classified as a financial asset in DT’s balance sheet). In May 2001 it completed the purchase of both companies by making a further cash payment of A4.9 billion and issuing new shares with a market value of A28.7 billion. The two companies were included in DT’s consolidated accounts in 2001. They carried around A9.5 billion of debt on their books at the time of consolidation and were responsible for most of the increase in DT’s intangibles (largely, mobile phone licences and goodwill) that year. Together they made a net loss of A3.1 billion in 2001.

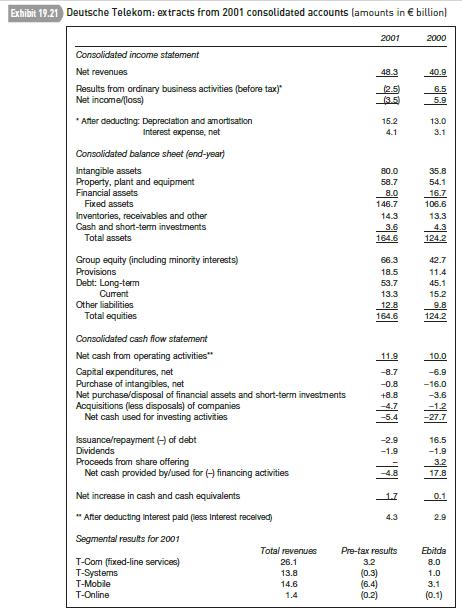

Summary financial statements, taken from DT’s 2001 consolidated accounts, are set out in Exhibit 19.21.

Required

(a) Calculate the following ratios for 2000 and 2001:

(i) end-year net debt–equity ratio;

(ii) times interest earned ratio;

(iii) end-year net debt-to-Ebitda ratio.

Based on your calculations of these ratios, was DT less or more able to service its debts in 2001 than in 2000? What other aspects of the group’s operations or capital structure might give investors cause for concern about its financial health?

(b) An investor has doubts about the reliability of DT’s published 2001 figures. He queries the group’s reported debt and shareholders’ equity numbers.

(i) ‘How can the group record a net repayment of debt on the cash flow statement when its balance sheet debt increases between the start and end of the year?’

(ii) ‘How can the group record an increase in group equity when it reports a loss in the year – and there’s no evidence in the cash flow statement of a share issue in 2001?’

Answer the investor’s questions. Explain why the group’s debt and shareholders’ equity increase in 2001 despite debt repayments and losses in the year.AppenedixLO1

Step by Step Answer: