(Backflush costing) Refined Products uses backflush costing to account for production costs of its clothing line. During...

Question:

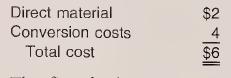

(Backflush costing) Refined Products uses backflush costing to account for production costs of its clothing line. During August 2006, the firm produced 160,000 garments and sold 159,000. The standard cost for each garment is

The finn had no inventory on August 1. The following events took place in August:

• Purchased $322,000 of direct material.

• Incurred $648,000 of conversion costs.

• Applied $640,000 of conversion costs to Raw and In-Process Inventory.

• Finished 160,000 garments.

• Sold 159,000 garments for $10 each.

a. Prepare journal entries using backflush costing with a minimum number of entries.

b. Post the amounts in part

(a) to T-accounts.

C. Explain any inventory account balances.

Step by Step Answer:

Cost Accounting Foundations And Evolutions

ISBN: 9780324235012

6th Edition

Authors: Michael R. Kinney, Jenice Prather-Kinsey, Cecily A. Raiborn