(Comprehensive) In May 1998, Tucson Construction Company was the successful bidder on a contract to build a...

Question:

(Comprehensive) In May 1998, Tucson Construction Company was the successful bidder on a contract to build a pedestrian overpass in Phoenix. The firm utilizes a job order costing system, and this job was assigned Job #515. The contract price for the overpass was $150,000. The owners of Tucson Construction agreed to a completion date of December 15, 1998, for the contract. The firm’s engi¬ neering and cost accounting departments estimated the following costs for com¬ pletion of the overpass: $40,000 for direct material, $45,000 for direct labor, and $27,000 for overhead.

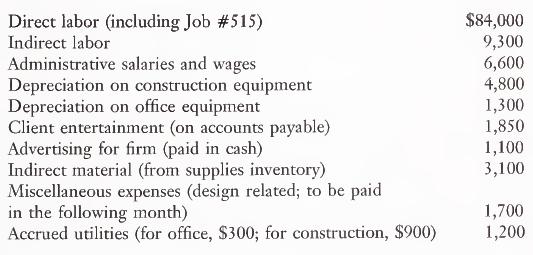

The firm began work on the overpass in August. During August, direct material cost assigned to Job #515 was $10,300 and direct labor cost associated with Job #515 was $15,840. The firm uses a predetermined overhead rate of 60 percent of direct labor cost. Tucson Construction also worked on several othci jobs during August and incurred the following costs:

During August, Tucson Construction completed several jobs that had been in process before the beginning of the month. These completed jobs generated $104,000 of revenues for the company. The related job cost sheets showed costs associated with those jobs of $71,500. At the beginning of August, Tucson Con¬ struction had Work in Process Inventory of $45,300.

a. Prepare a job order cost sheet for Job #515, including all job details, and post the appropriate cost information for August.

b. Prepare journal entries for the above information.

c. Prepare a Schedule of Cost of Goods Manufactured for August for Tucson Construction Company.

d. Assuming the company pays income tax at a 36 percent rate, prepare an income statement for August.LO1

Step by Step Answer:

Cost Accounting Traditions And Innovations

ISBN: 9780538880473

3rd Edition

Authors: Jesse T. Barfield, Cecily A. Raiborn, Michael R. Kinney